Question: Question 3 Printing Company Ltd . ( PC ) prints customised training material for customers. The major differences among job orders are typesetting and order

Question

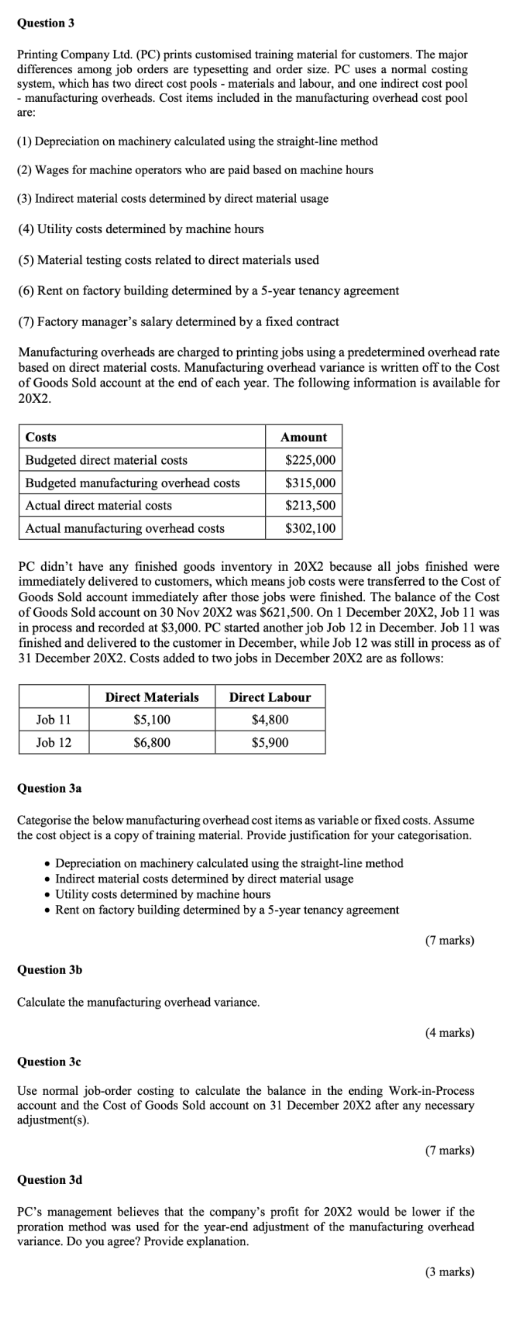

Printing Company LtdPC prints customised training material for customers. The major differences among job orders are typesetting and order size. PC uses a normal costing system, which has two direct cost pools materials and labour, and one indirect cost pool manufacturing overheads. Cost items included in the manufacturing overhead cost pool are:

Depreciation on machinery calculated using the straightline method

Wages for machine operators who are paid based on machine hours

Indirect material costs determined by direct material usage

Utility costs determined by machine hours

Material testing costs related to direct materials used

Rent on factory building determined by a year tenancy agreement

Factory manager's salary determined by a fixed contract

Manufacturing overheads are charged to printing jobs using a predetermined overhead rate based on direct material costs. Manufacturing overhead variance is written off to the Cost of Goods Sold account at the end of each year. The following information is available for X

PC didn't have any finished goods inventory in X because all jobs finished were immediately delivered to customers, which means job costs were transferred to the Cost of Goods Sold account immediately after those jobs were finished. The balance of the Cost of Goods Sold account on Nov X was $ On December X Job was in process and recorded at $ PC started another job Job in December. Job was finished and delivered to the customer in December, while Job was still in process as of December X Costs added to two jobs in December X are as follows:

Question a

Categorise the below manufacturing overhead cost items as variable or fixed costs. Assume the cost object is a copy of training material. Provide justification for your categorisation.

Depreciation on machinery calculated using the straightline method

Indirect material costs determined by direct material usage

Utility costs determined by machine hours

Rent on factory building determined by a year tenancy agreement

Question b

Calculate the manufacturing overhead variance.

marks

Question c

Use normal joborder costing to calculate the balance in the ending WorkinProcess account and the Cost of Goods Sold account on December X after any necessary adjustments

marks

Question d

PCs management believes that the company's profit for X would be lower if the proration method was used for the yearend adjustment of the manufacturing overhead variance. Do you agree? Provide explanation.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock