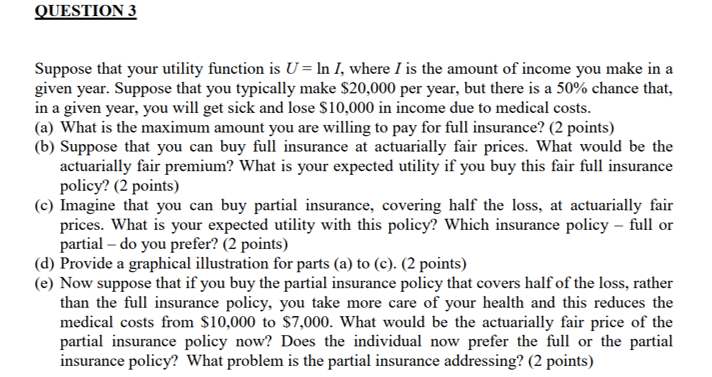

Question: QUESTION 3 Suppose that your utility function is U = ln I, where I is the amount of income you make in a given year.

QUESTION 3

Suppose that your utility function is U = ln I, where I is the amount of income you make in a

given year. Suppose that you typically make $20,000 per year, but there is a 50% chance that,

in a given year, you will get sick and lose $10,000 in income due to medical costs.

(a) What is the maximum amount you are willing to pay for full insurance? (2 points)

(b) Suppose that you can buy full insurance at actuarially fair prices. What would be the

actuarially fair premium? What is your expected utility if you buy this fair full insurance

policy? (2 points)

(c) Imagine that you can buy partial insurance, covering half the loss, at actuarially fair

prices. What is your expected utility with this policy? Which insurance policy - full or

partial - do you prefer? (2 points)

(d) Provide a graphical illustration for parts (a) to (c). (2 points)

(e) Now suppose that if you buy the partial insurance policy that covers half of the loss, rather

than the full insurance policy, you take more care of your health and this reduces the

medical costs from $10,000 to $7,000. What would be the actuarially fair price of the

partial insurance policy now? Does the individual now prefer the full or the partial

insurance policy? What problem is the partial insurance addressing? (2 points)

UESTIDN 3 Suppose that your utility function is U = lo I, where I is the amount of income you make in a given year. Suppose that you typically malte $211,090 per year, but there is a 512%- chance that, in a given year, you will get sick and lose 5 ltlt] in income due to medical costs. {a} What is the maximum amount you are willing to pay for tll insurance? {2 points) {h} Suppose that you can buy full insurance at actuarially fair prices. What would he the actuarially Fair premium? What is your expected utility if you huy this fair full insurance P0\"??? (2 Points) {c} Imagine that you can buy partial insurance, covering half the loss, at actuarially fair prices. What is your expected utility with this policy? Which insurance policy full or partial do you prefer? {2 points} {d} Provide a graphical illustration for parts {a} to {c}. [2 points] {e} Now suppose that if you buy the partial insurance policy that covers half of the loss, rather than the full insurance policy, you take more care of your health and this reduces the medical costs from $l,tl to 3?,. What would be the actuarially fair price of the partial insurance policy now? Does the individual now prefer the lll or the partial insurance policy? What problem is the partial insurance addressing? {2 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts