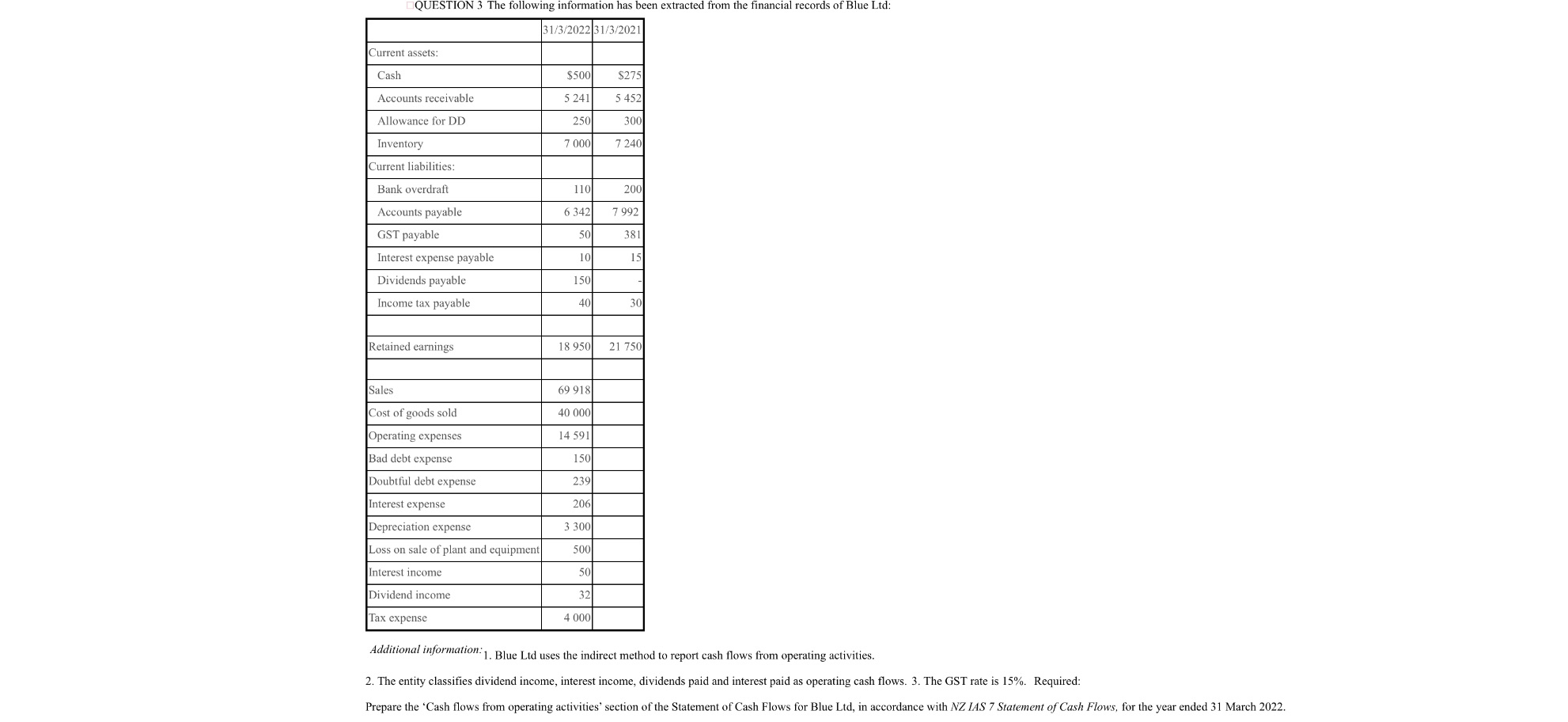

Question: QUESTION 3 The following information has been extracted from the financial records of Blue Ltd: $1/3/2022 31/3/2021 Current assets: Cash $500 $275 Accounts receivable 5

QUESTION 3 The following information has been extracted from the financial records of Blue Ltd: $1/3/2022 31/3/2021 Current assets: Cash $500 $275 Accounts receivable 5 24 5 452 Allowance for DD 250 300 Inventory 7 000 7 240 Current liabilities: Bank overdraft 110 200 Accounts payable 5 342 7 992 GST payable 50 381 Interest expense payable 10 15 Dividends payable 150 Income tax payable 40 30 Retained earnings 18 950 21 750 Sales 69 918 Cost of goods sold 40 000 Operating expenses 14 59 Bad debt expense 150 Doubtful debt expense 239 Interest expense 206 Depreciation expense 3 30 Loss on sale of plant and equipment 500 Interest income 50 Dividend income 32 Tax expense 4 00 Additional information: 1. Blue Lid uses the indirect method to report cash flows from operating activities. 2. The entity classifies dividend income, interest income, dividends paid and interest paid as operating cash flows. 3. The GST rate is 15%. Required: Prepare the 'Cash flows from operating activities' section of the Statement of Cash Flows for Blue Lid, in accordance with NZ IAS 7 Statement of Cash Flows, for the year ended 31 March 2022

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts