Question: QUESTION 3 The minimum variance hedge ratio is: a. Required: Assume the asset hedged is the same as the asset underlying the futures or forward

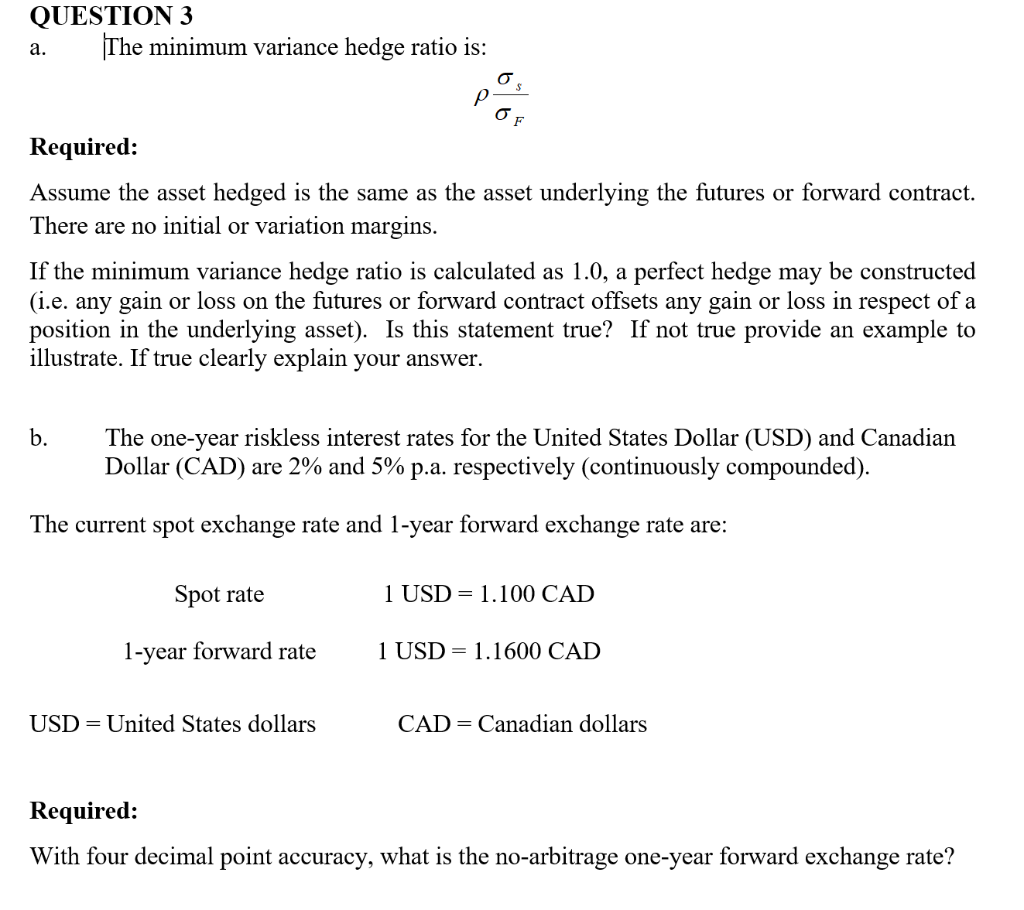

QUESTION 3 The minimum variance hedge ratio is: a. Required: Assume the asset hedged is the same as the asset underlying the futures or forward contract. There are no initial or variation margins. If the minimum variance hedge ratio is calculated as 1.0, a perfect hedge may be constructed (i.e. any gain or loss on the futures or forward contract offsets any gain or loss in respect of a position in the underlying asset). Is this statement true? If not true provide an example to illustrate. If true clearly explain your answer. b. The one-year riskless interest rates for the United States Dollar (USD) and Canadian Dollar (CAD) are 2% and 5% p.a. respectively (continuously compounded). The current spot exchange rate and 1-year forward exchange rate are: Spot rate 1 USD = 1.100 CAD 1-year forward rate 1 USD = 1.1600 CAD USD = United States dollars CAD = Canadian dollars Required: With four decimal point accuracy, what is the no-arbitrage one-year forward exchange rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts