Question: Question 3 Using data from Wall Street Journal Market Diary, CBOE Daily Market Statistics and other financial data sources ( e . g . TR

Question

Using data from Wall Street Journal Market Diary, CBOE Daily Market Statistics and other financial data

sources eg TR Eikon, Bloomberg, Yahoo Finance, etc. calculate the following using the most recent

trading days your reference day can be the day you get the data to answer this question. Please indicate the

date clearly and include the data you use to answer this question.

a Trin ratio for the NYSE. Is the trin ratio bullish or bearish in each of the days?

b Relative strength of TESLA relative to industry index. Based on days of data, does TESLA

outperform or underperform the industry?

c Cumulative breadth for the NYSE for the most recent days. Can you infer any broad market

trend?

d PutCall ratio from CBOE Chicago Boards Option Exchange Do you infer investor pessimism

or optimism based on most recent days of data?

Question

Log on to

finance.yahoo.com or any other financial database of your choice to find the monthly dividend

adjusted closing prices for the most recent years for Abercrombie & Fitch ANF Also, collect the closing

level of the S&P Index over the same period.

Calculate the month moving average of both the stock and the S&P over time. For each series, use

Excel to plot the moving average against the actual level of the stock price or index. Examine the instances

where the moving average and price series cross.

Is the stock more or less likely to increase when the price crosses through the moving average?

Does it matter whether the price crosses the moving average from above or below?

How reliable would an investment rule based on moving averages be

Part II

Question

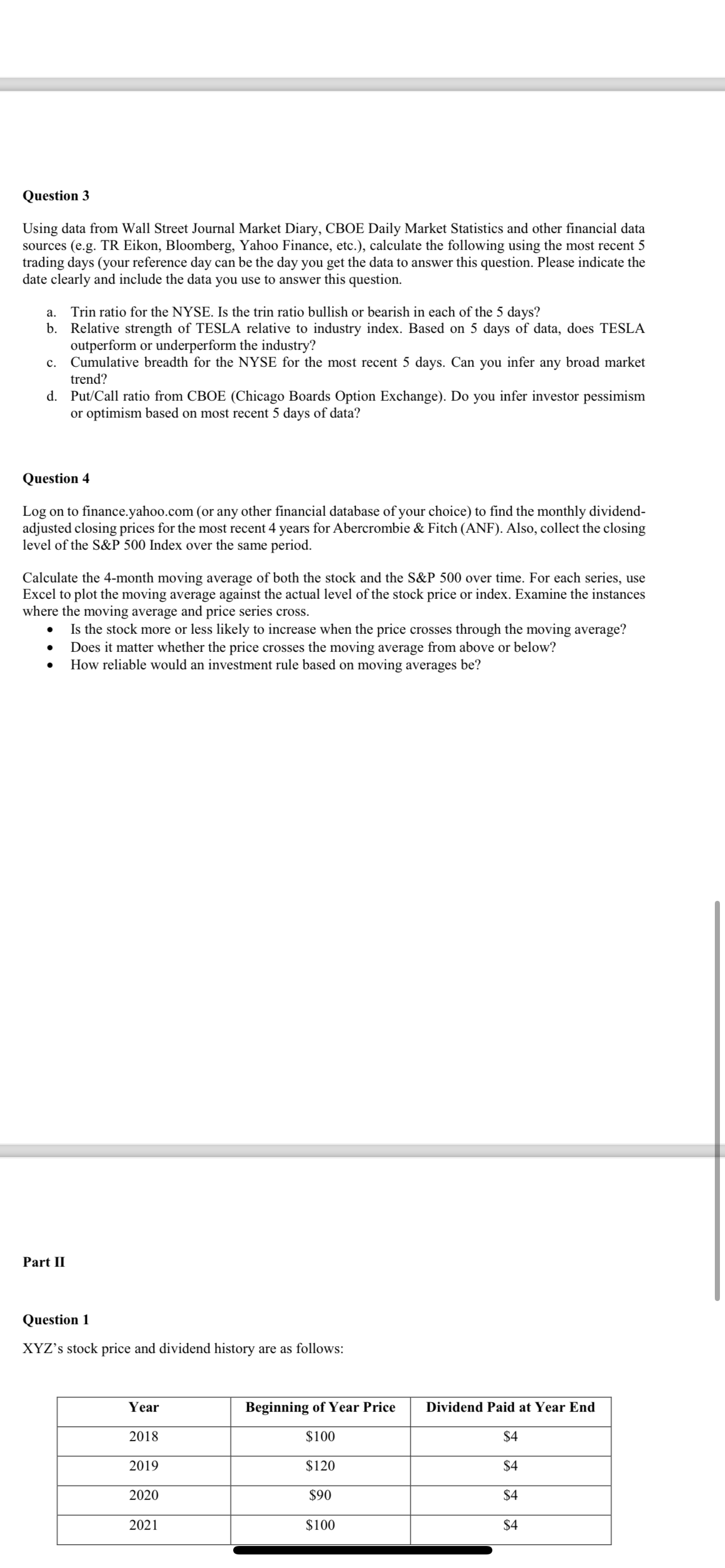

XYZs stock price and dividend history are as follows:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock