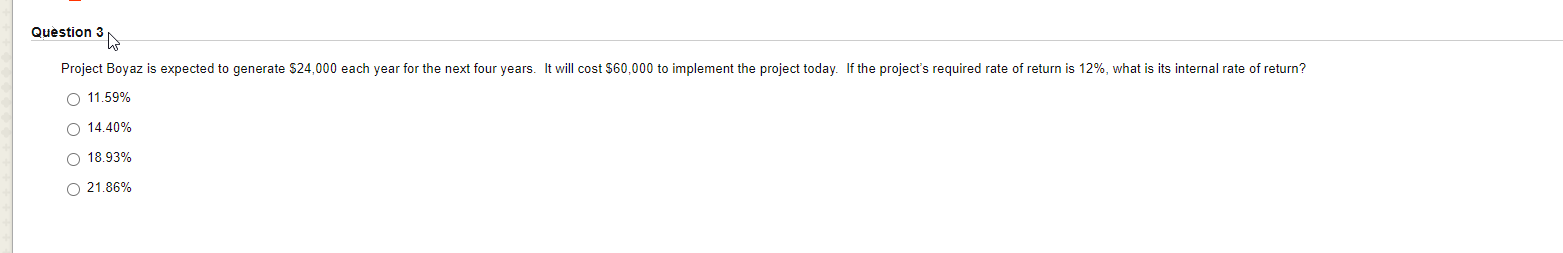

Question: Question 3 W Project Boyaz is expected to generate $24,000 each year for the next four years. It will cost $60,000 to implement the project

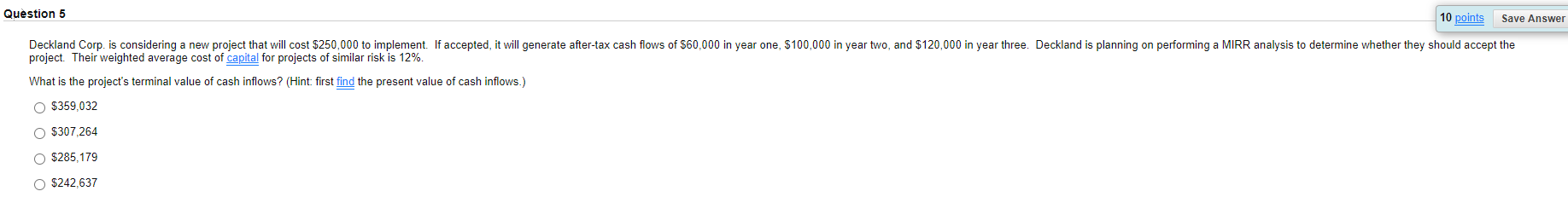

Question 3 W Project Boyaz is expected to generate $24,000 each year for the next four years. It will cost $60,000 to implement the project today. If the project's required rate of return is 12%, what is its internal rate of return? 11.59% 14.40% 18.93% 21.86% Question 5 10 points Save Answer Deckland Corp. is considering a new project that will cost $250,000 to implement. If accepted, it will generate after-tax cash flows of $60,000 in year one, $100,000 in year two, and $120,000 in year three. Deckland is planning on performing a MIRR analysis to determine whether they should accept the project. Their weighted average cost of capital for projects of similar risk is 12%. What is the project's terminal value of cash inflows? (Hint: first find the present value of cash inflows.) O $359,032 O $307264 $285,179 O $242,637

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts