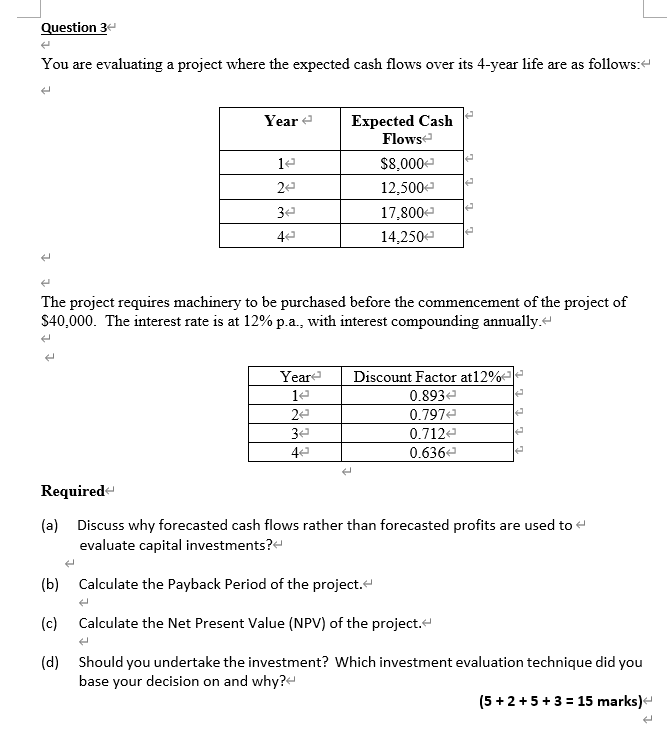

Question: Question 3 You are evaluating a project where the expected cash flows over its 4-year life are as follows: Year 12 Expected Cash Flows $8,000

Question 3 You are evaluating a project where the expected cash flows over its 4-year life are as follows: Year 12 Expected Cash Flows $8,000 12,500 17.800 14,250 2 3e 42 13 The project requires machinery to be purchased before the commencement of the project of $40,000. The interest rate is at 12% p.a., with interest compounding annually. Year le 2 Discount Factor at 12% 0.893e 0.7972 0.712e 0.6362 3e 42 Required (a) Discuss why forecasted cash flows rather than forecasted profits are used to evaluate capital investments? (b) Calculate the Payback period of the project. (c) Calculate the Net Present Value (NPV) of the project. (d) Should you undertake the investment? Which investment evaluation technique did you base your decision on and why? (5 + 2 + 5 + 3 = 15 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts