Question: QUESTION 3 You form a long straddle by buying a call with a premium of C = $6, and buying a put with a premium

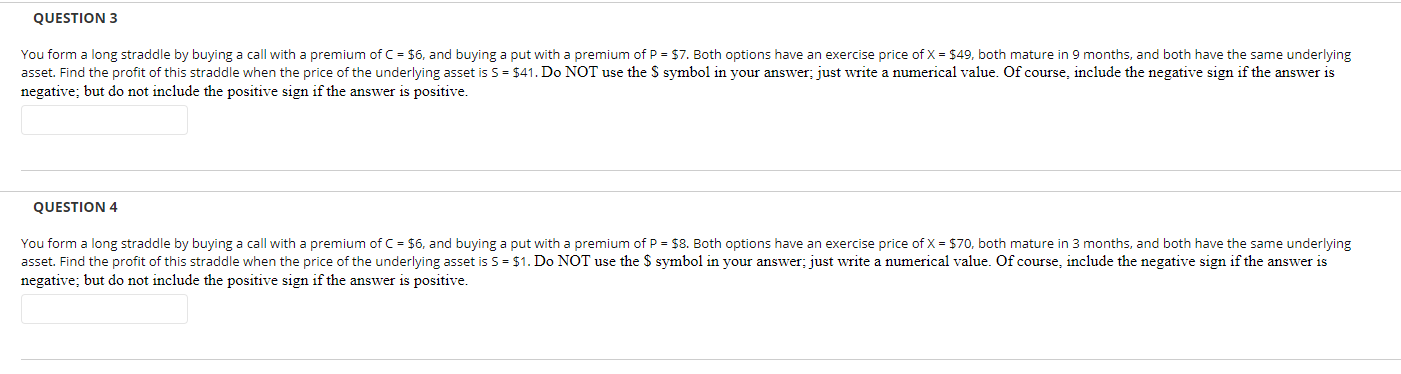

QUESTION 3 You form a long straddle by buying a call with a premium of C = $6, and buying a put with a premium of P = $7. Both options have an exercise price of X = $49, both mature in 9 months, and both have the same underlying asset. Find the profit of this straddle when the price of the underlying asset is 5 = $41. Do NOT use the S symbol in your answer; just write a numerical value. Of course, include the negative sign if the answer is negative; but do not include the positive sign if the answer is positive. QUESTION 4 You form a long straddle by buying a call with a premium of C = $6, and buying a put with a premium of P = $8. Both options have an exercise price of X = $70, both mature in 3 months, and both have the same underlying asset. Find the profit of this straddle when the price of the underlying asset is 5 = $1. Do NOT use the symbol in your answer: just write a numerical value. Of course, include the negative sign if the answer is negative; but do not include the positive sign if the answer is positive

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts