Question: Question 3 Your firm is considering leasing a new computer. The lease lasts for 9 years. The lease calls for 10 payments of $1,000,000 per

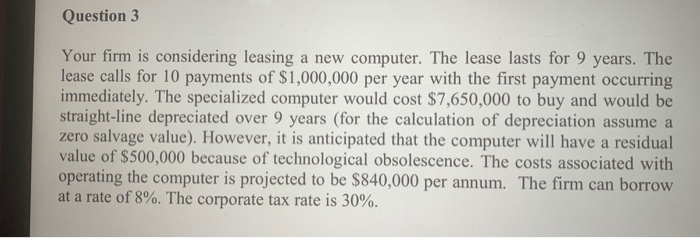

Question 3 Your firm is considering leasing a new computer. The lease lasts for 9 years. The lease calls for 10 payments of $1,000,000 per year with the first payment occurring immediately. The specialized computer would cost $7,650,000 to buy and would be straight-line depreciated over 9 years (for the calculation of depreciation assume a zero salvage value). However, it is anticipated that the computer will have a residual value of $500,000 because of technological obsolescence. The costs associated with operating the computer is projected to be $840,000 per annum. The firm can borrow at a rate of 8%. The corporate tax rate is 30%. Required: (a) Should the computer be leased or purchased? justify your answer. Provide your calculations to (15 marks) (b) What are some good reasons for leasing instead of buying? (5 marks) (c) For a firm using financial leases can its debt-to-equity ratio be considered as inadequate measure of the firm financial leverage

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts