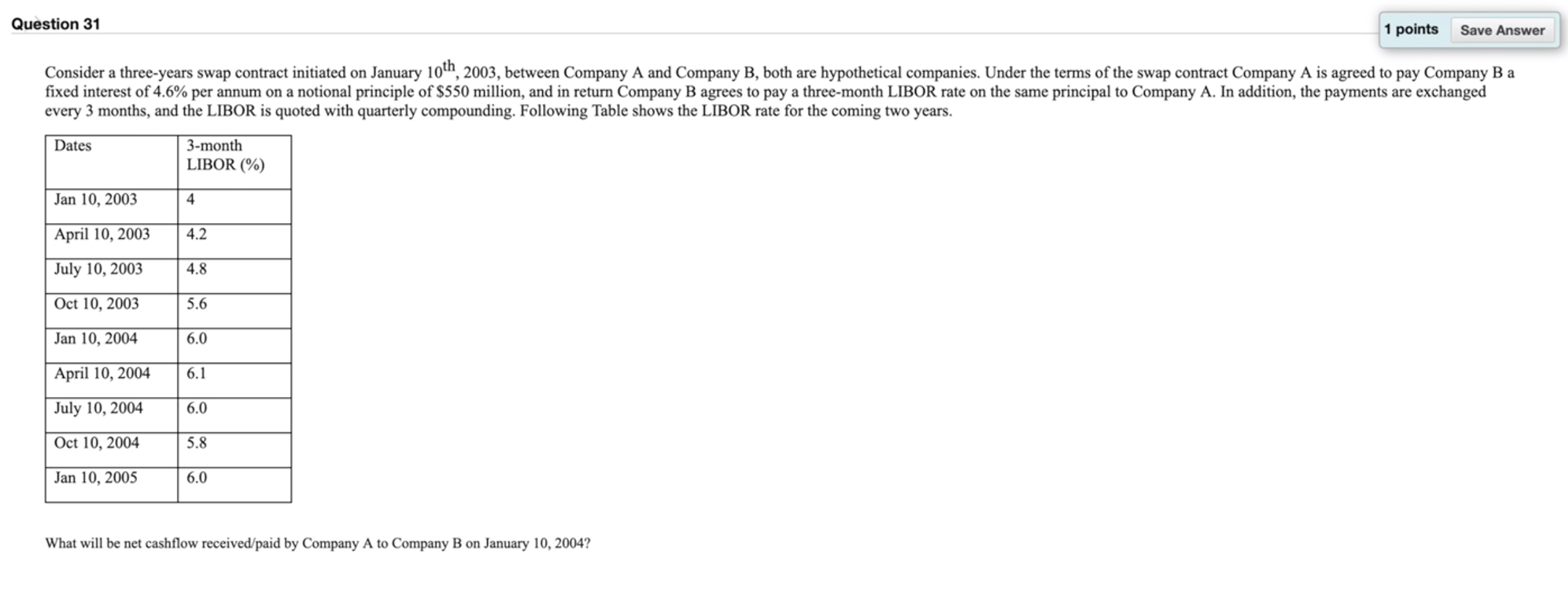

Question: Question 31 1 points Save Answer Consider a three-years swap contract initiated on January 10th, 2003, between Company A and Company B, both are hypothetical

Question 31 1 points Save Answer Consider a three-years swap contract initiated on January 10th, 2003, between Company A and Company B, both are hypothetical companies. Under the terms of the swap contract Company A is agreed to pay Company B a fixed interest of 4.6% per annum on a notional principle of $550 million, and in return Company B agrees to pay a three-month LIBOR rate on the same principal to Company A. In addition, the payments are exchanged every 3 months, and the LIBOR is quoted with quarterly compounding. Following Table shows the LIBOR rate for the coming two years. Dates LIBOR (%) Jan 10, 2003 3-month 4 April 10, 2003 4.2 July 10, 2003 4.8 Oct 10, 2003 5.6 Jan 10, 2004 6.0 6.1 April 10, 2004 July 10, 2004 6.0 Oct 10, 2004 5.8 Jan 10, 2005 6.0 What will be net cashflow received/paid by Company A to Company B on January 10, 2004? Question 32 In previous question, how did you compute the net cashflow received/paid by Company A to Company B on January 10, 2004? TTTF Paragraph Arial 3 (12pt)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts