Question: Question 31 (8 points) Question 31. Suppose the current interest rate on a one-year bond is 5 percent and the expected short-term interest rates for

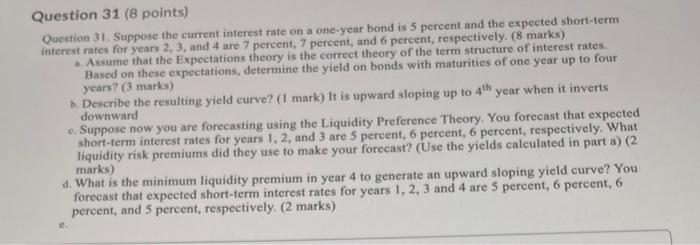

Question 31 (8 points) Question 31. Suppose the current interest rate on a one-year bond is 5 percent and the expected short-term interest rates for years 2, 3, and 4 are 7 percent, 7 percent, and 6 percent, respectively. (8 marks) - Assume that the Expectations theory is the correct theory of the term structure of interest rates Based on these expectations, determine the yield on bonds with maturities of one year up to four years? (3 marks) Describe the resulting yield curve? (1 mark) It is upward sloping up to 4th year when it inverts downward Suppose now you are forecasting using the Liquidity Preference Theory. You forecast that expected short-term interest rates for years 1, 2, and 3 are 5 percent, 6 percent, 6 percent, respectively. What liquidity risk premiums did they use to make your forecast? (Use the yields calculated in part a) (2 marks) d. What is the minimum liquidity premium in year 4 to generate an upward sloping yield curve? You forecast that expected short-term interest rates for years 1, 2, 3 and 4 are 5 percent, 6 percent, 6 percent, and 5 percent, respectively. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts