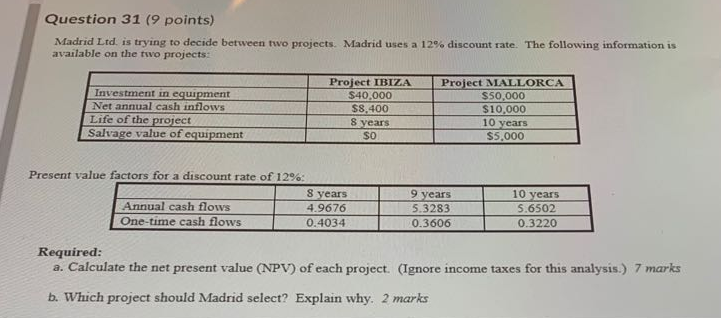

Question: Question 31 (9 points) Madrid Ltd. is trying to decide between two projects. Madrid uses a 12% discount rate. The following information is available on

Question 31 (9 points) Madrid Ltd. is trying to decide between two projects. Madrid uses a 12% discount rate. The following information is available on the two projects Investment in equipment Net annual cash inflows Life of the project Salvage value of equipment Project IBIZA $40,000 $8,400 Project MALLORCA $50,000 $10,000 10 years $5.000 8 years SO Present value factors for a discount rate of 12%: 8 years Annual cash flows 4.9676 One-time cash flows 0.4034 9 years 5.3283 0.3606 10 years 5.6502 0.3220 Required: a. Calculate the net present value (NPV) of each project. (Ignore income taxes for this analysis.) 7 marks b. Which project should Madrid select? Explain why. 2 marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts