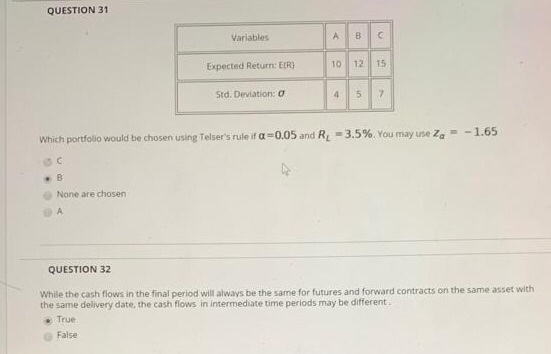

Question: QUESTION 31 Variables A B Expected Return: ER 10 12 15 Srd. Deviation: 4 5 7 Which portfolio would be chosen using Telser's rule if

QUESTION 31 Variables A B Expected Return: ER 10 12 15 Srd. Deviation: 4 5 7 Which portfolio would be chosen using Telser's rule if a=0.05 and R = 3.5%. You may use Za = -1.65 None are chosen QUESTION 32 While the cash flows in the final period will always be the same for futures and forward contracts on the same asset with the same delivery date, the cash flows in intermediate time periods may be different True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts