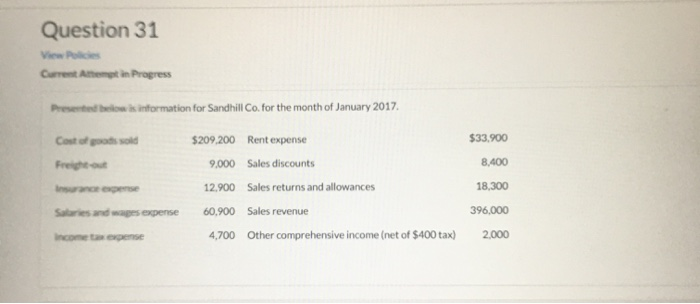

Question: Question 31 View Policies Current Attempt in Progress Presented below is information for Sandhill Co. for the month of January 2017 $209,200 Rent expense $33.900

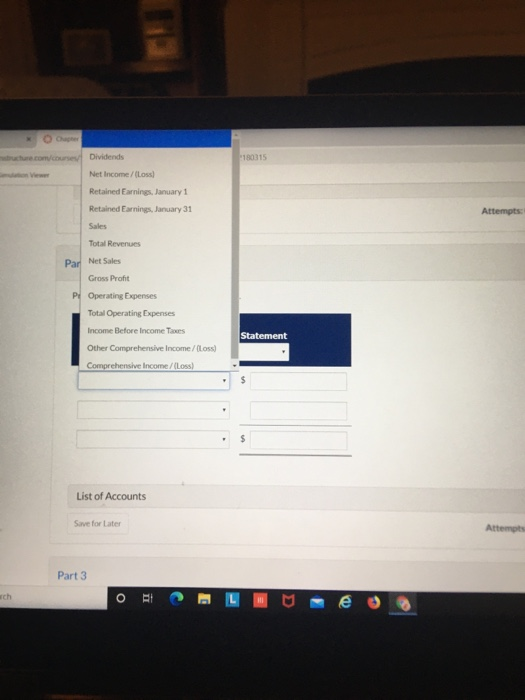

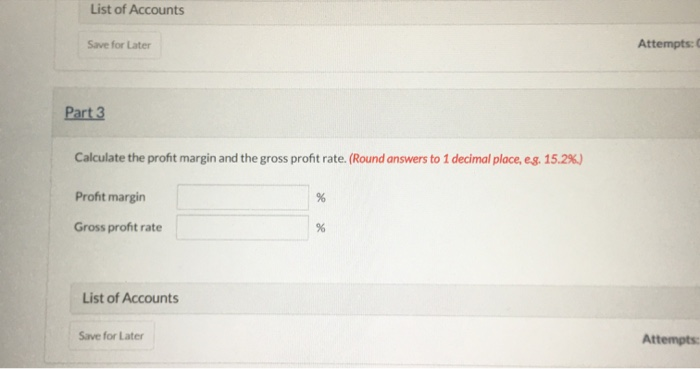

Question 31 View Policies Current Attempt in Progress Presented below is information for Sandhill Co. for the month of January 2017 $209,200 Rent expense $33.900 9,000 Sales discounts 8.400 Cost of goods sold Freight-out Insurance expense Salaries and wages expense 12.900 Sales returns and allowances 60,900 Sales revenue 4,700 Other comprehensive income (net of $400 tax) 18,300 396,000 2,000 Income expense Dividends Attempts: Net Income/(Loss) Retained Earnings, January 1 Retained Earnings, January 31 Sales Total Revenues Net Sales Gross Profit P: Operating Expenses Total Operating Expenses Income Before Income Tars Statement Other Comprehensive Income /(Loss) Comprehensive Income /(Loss) List of Accounts Save for Later Attempts Part 3 arch List of Accounts Save for Later Attempts: Part 3 Calculate the profit margin and the gross profit rate. (Round answers to 1 decimal place, eg. 15.2%) Profit margin a Gross profit rate de List of Accounts Save for Later Attempts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts