Question: Question 32 1 pts In a defined contribution plan, a formula is used that defines the benefits that the employee will receive at the time

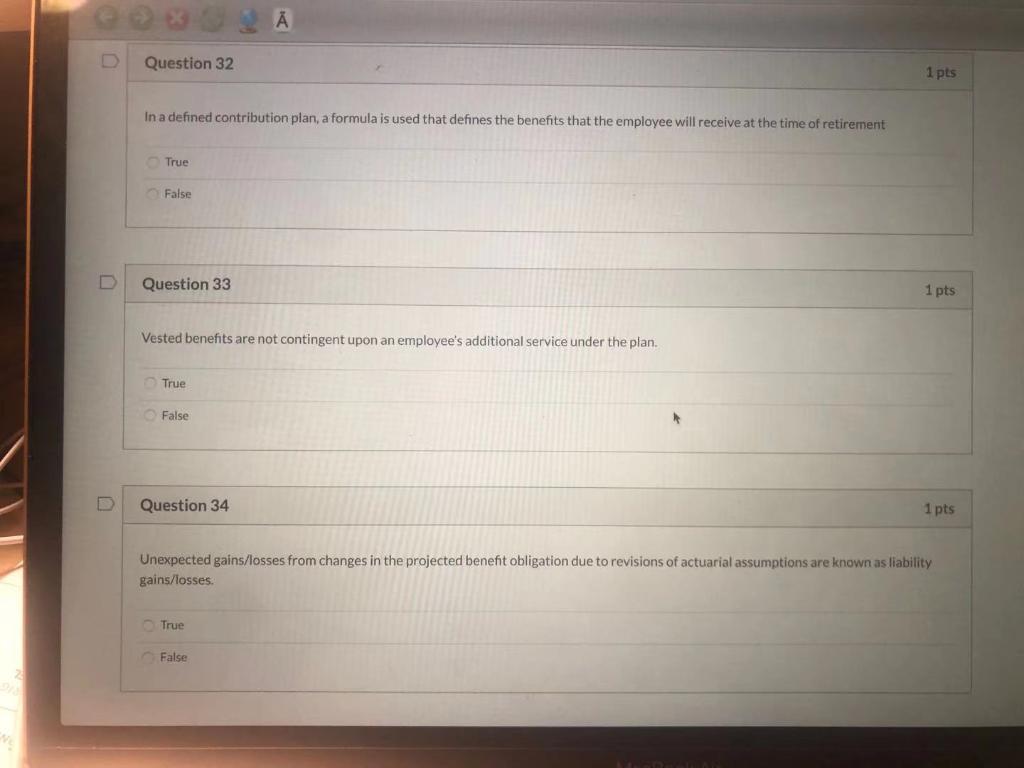

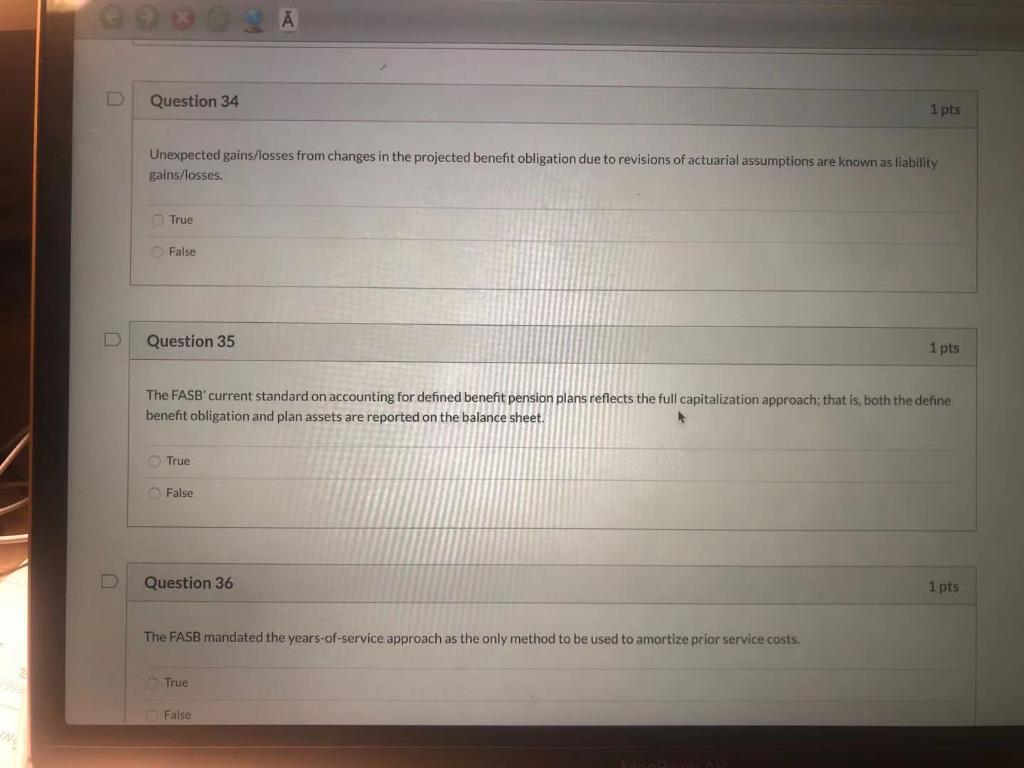

Question 32 1 pts In a defined contribution plan, a formula is used that defines the benefits that the employee will receive at the time of retirement True False Question 33 1 pts Vested benefits are not contingent upon an employee's additional service under the plan. True False Question 34 1 pts Unexpected gains/losses from changes in the projected benefit obligation due to revisions of actuarial assumptions are known as liability gains/losses. True False Question 34 1 pts Unexpected gains/losses from changes in the projected benefit obligation due to revisions of actuarial assumptions are known as liability gains/losses. True False Question 35 1 pts The FASB' current standard on accounting for defined benefit pension plans reflects the full capitalization approach; that is, both the define benefit obligation and plan assets are reported on the balance sheet. True False Question 36 1 pts The FASB mandated the years-of-service approach as the only method to be used to amortize prior service costs. True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts