Question: Question 32 2.5 points Save Answ. In class, we discussed the concept of a Risk / Return Trade-Off Diagram (see below). On this graph, a

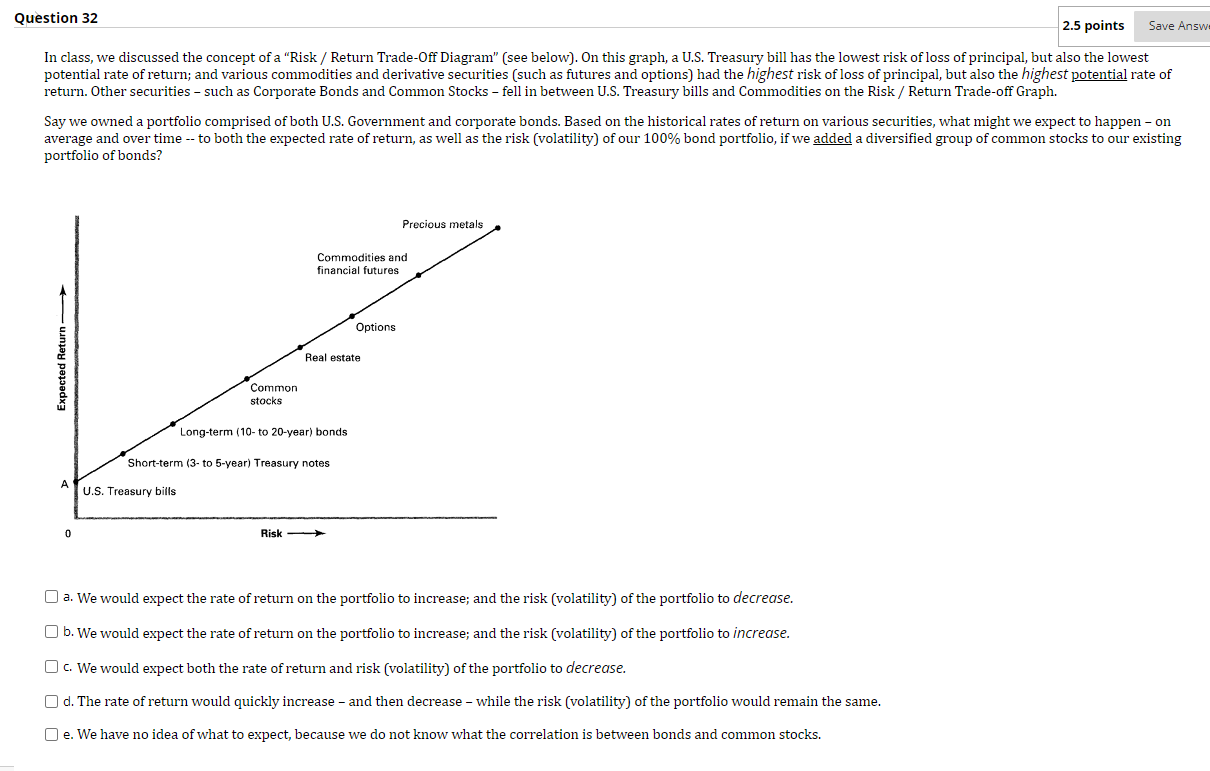

Question 32 2.5 points Save Answ. In class, we discussed the concept of a "Risk / Return Trade-Off Diagram" (see below). On this graph, a U.S. Treasury bill has the lowest risk of loss of principal, but also the lowest potential rate of return; and various commodities and derivative securities (such as futures and options) had the highest risk of loss of principal, but also the highest potential rate of return. Other securities - such as Corporate Bonds and Common Stocks - fell in between U.S. Treasury bills and Commodities on the Risk / Return Trade-off Graph. Say we owned a portfolio comprised of both U.S. Government and corporate bonds. Based on the historical rates of return on various securities, what might we expect to happen - on average and over time -- to both the expected rate of return, as well as the risk (volatility) of our 100% bond portfolio, if we added a diversified group of common stocks to our existing portfolio of bonds? Precious metals Commodities and financial futures Options Expected Return Real estate Common stocks Long-term (10-to 20-year) bonds hort-term to 5-year) Treasury notes U.S. Treasury bills 0 Risk a. We would expect the rate of return on the portfolio to increase; and the risk (volatility) of the portfolio to decrease. b. We would expect the rate of return on the portfolio to increase; and the risk (volatility) of the portfolio to increase. c. We would expect both the rate of return and risk (volatility) of the portfolio to decrease. d. The rate of return would quickly increase - and then decrease - while the risk (volatility) of the portfolio would remain the same. e. We have no idea of what to expect, because we do not know what the correlation is between bonds and common stocks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts