Question: Question 32 (5 points) Indicate whether the following statement is True or False and explain your answer in as much detail as possible. No marks

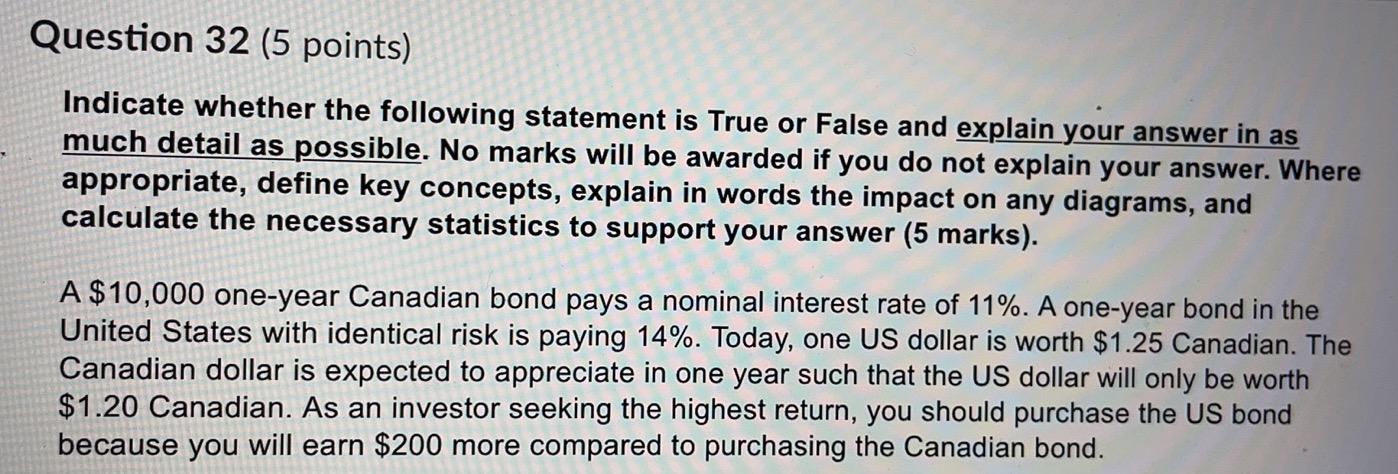

Question 32 (5 points) Indicate whether the following statement is True or False and explain your answer in as much detail as possible. No marks will be awarded if you do not explain your answer. Where appropriate, define key concepts, explain in words the impact on any diagrams, and calculate the necessary statistics to support your answer (5 marks). A $10,000 one-year Canadian bond pays a nominal interest rate of 11%. A one-year bond in the United States with identical risk is paying 14%. Today, one US dollar is worth $1.25 Canadian. The Canadian dollar is expected to appreciate in one year such that the US dollar will only be worth $1.20 Canadian. As an investor seeking the highest return, you should purchase the US bond because you will earn $200 more compared to purchasing the Canadian bond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts