Question: QUESTION 32 Poon's Noodle House is considering replacing its noodle-processing machine. The new machine will cost $354,000 and will require an additional $59,000 for delivery

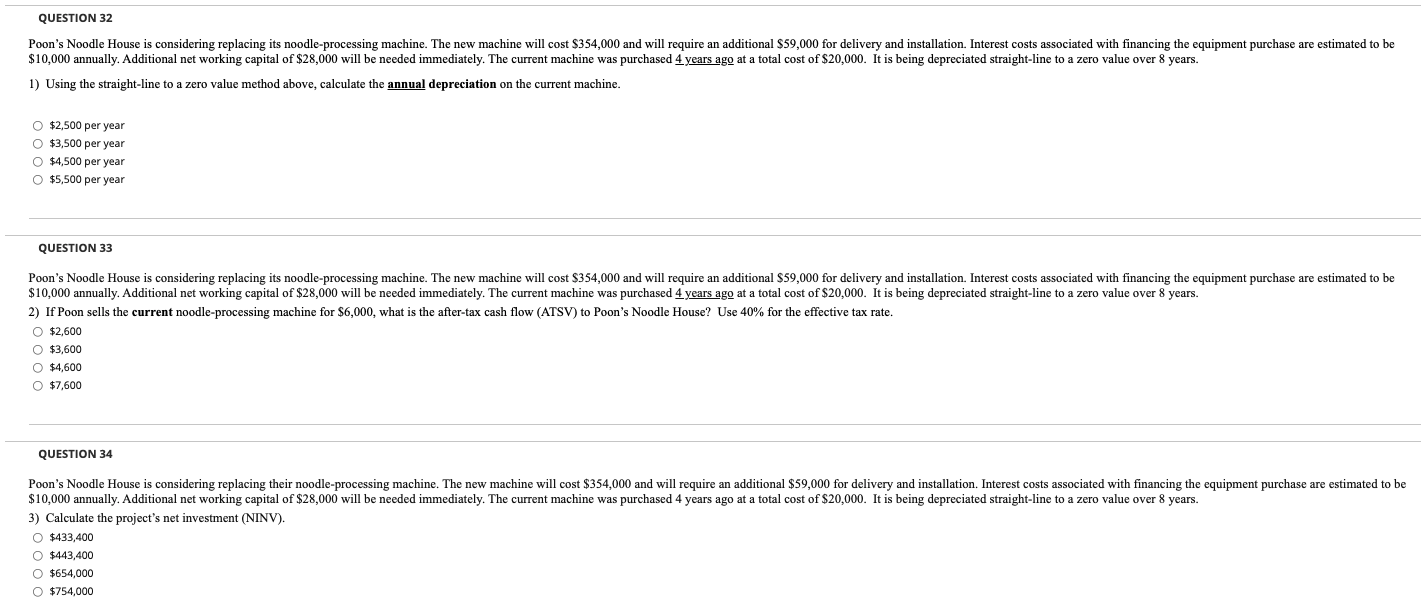

QUESTION 32 Poon's Noodle House is considering replacing its noodle-processing machine. The new machine will cost $354,000 and will require an additional $59,000 for delivery and installation. Interest costs associated with financing the equipment purchase are estimated to be $10,000 annually. Additional net working capital of $28,000 will be needed immediately. The current machine was purchased 4 years ago at a total cost of $20,000. It is being depreciated straight-line to a zero value over 8 years. 1) Using the straight-line to a zero value method above, calculate the annual depreciation on the current machine. $2,500 per year $3,500 per year $4,500 per year $5,500 per year QUESTION 33 Poon's Noodle House is considering replacing its noodle-processing machine. The new machine will cost $354,000 and will require an additional $59,000 for delivery and installation. Interest costs associated with financing the equipment purchase are estimated to be $10,000 annually. Additional net working capital of $28,000 will be needed immediately. The current machine was purchased 4 years ago at a total cost of $20,000. It is being depreciated straight-line to a zero value over 8 years. 2) If Poon sells the current noodle-processing machine for $6,000, what is the after-tax cash flow (ATSV) to Poon's Noodle House? Use 40% for the effective tax rate. O $2,600 O $3,600 O $4,600 $7,600 QUESTION 34 Poon's Noodle House is considering replacing their noodle-processing machine. The new machine will cost $354,000 and will require an additional $59,000 for delivery and installation. Interest costs associated with financing the equipment purchase are estimated to be $10,000 annually. Additional net working capital of $28,000 will be needed immediately. The current machine was purchased 4 years ago at a total cost of $20,000. It is being depreciated straight-line to a zero value over 8 years. 3) Calculate the project's net investment (NINV). O $433,400 0 $443,400 O $654,000 O $754,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts