Question: Question 33 (2.5 points) If a Lender applies both approaches 1. Loan to Value and 2. Debt Service Coverage Ratio, which one best describes

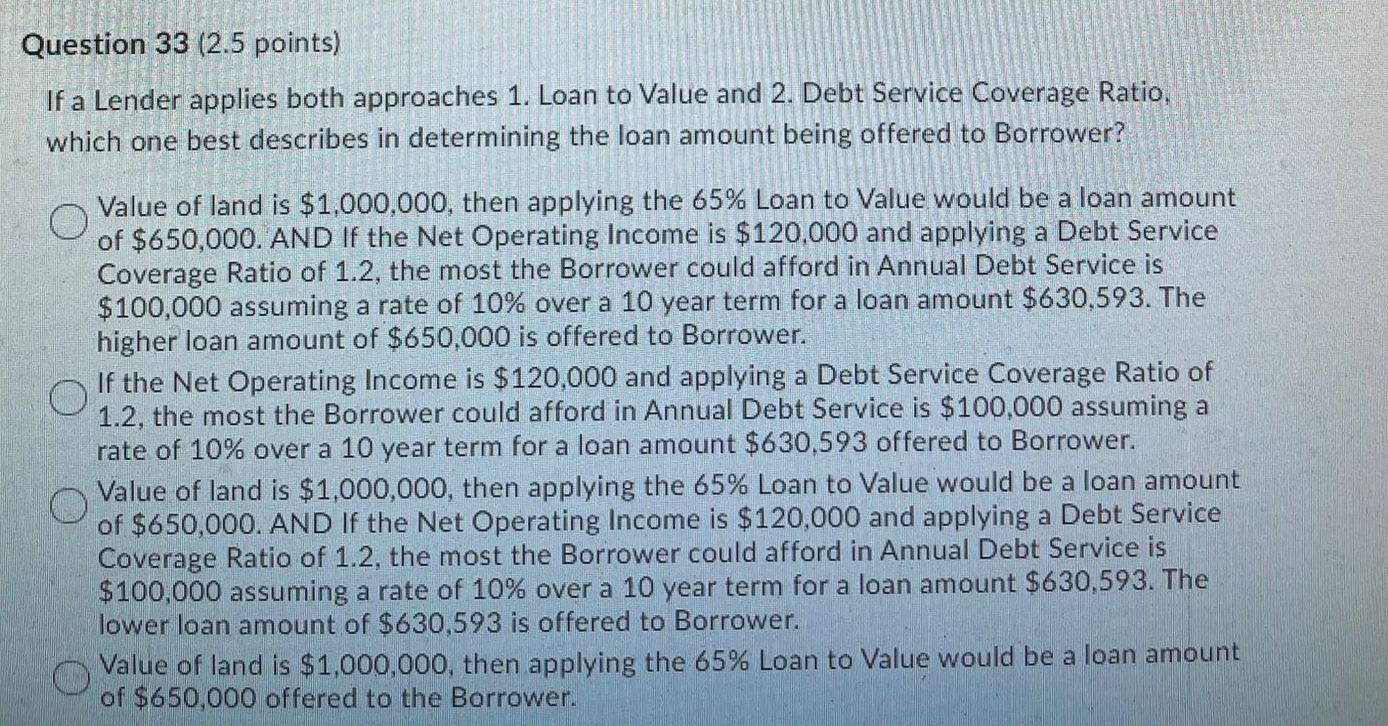

Question 33 (2.5 points) If a Lender applies both approaches 1. Loan to Value and 2. Debt Service Coverage Ratio, which one best describes in determining the loan amount being offered to Borrower? Value of land is $1,000,000, then applying the 65% Loan to Value would be a loan amount of $650,000. AND If the Net Operating Income is $120,000 and applying a Debt Service Coverage Ratio of 1.2, the most the Borrower could afford in Annual Debt Service is $100,000 assuming a rate of 10% over a 10 year term for a loan amount $630,593. The higher loan amount of $650,000 is offered to Borrower. O If the Net Operating Income is $120,000 and applying a Debt Service Coverage Ratio of 1.2, the most the Borrower could afford in Annual Debt Service is $100,000 assuming a rate of 10% over a 10 year term for a loan amount $630,593 offered to Borrower. Value of land is $1,000,000, then applying the 65% Loan to Value would be a loan amount of $650,000. AND If the Net Operating Income is $120,000 and applying a Debt Service Coverage Ratio of 1.2, the most the Borrower could afford in Annual Debt Service is $100,000 assuming a rate of 10% over a 10 year term for a loan amount $630,593. The lower loan amount of $630,593 is offered to Borrower. Value of land is $1,000,000, then applying the 65% Loan to Value would be a loan amount of $650,000 offered to the Borrower.

Step by Step Solution

There are 3 Steps involved in it

The detailed answer for the above question is provided below In the scenario you presented both Loan... View full answer

Get step-by-step solutions from verified subject matter experts