Question: Question 33 3 pts Comprehensive EPS Data for Fox Co. 2021 calendar year: 1/1/2021: Fox's outstanding shares: 100,000 common ($1 par) 10,000 cumulative 4% preferred

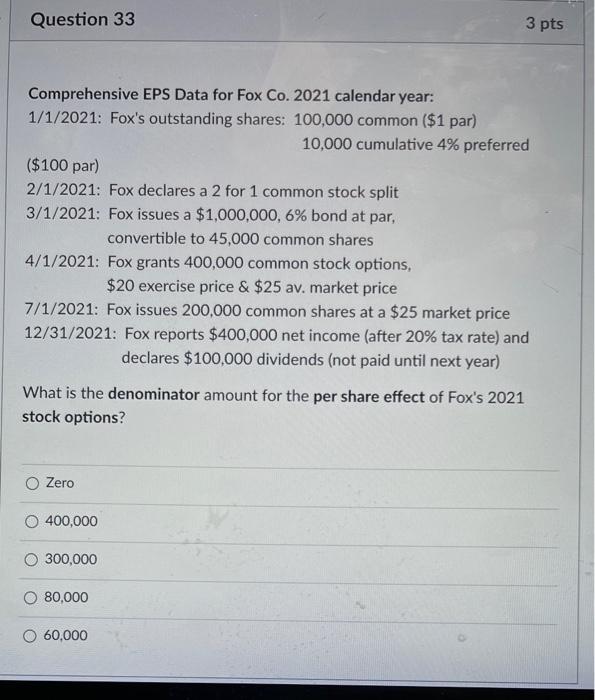

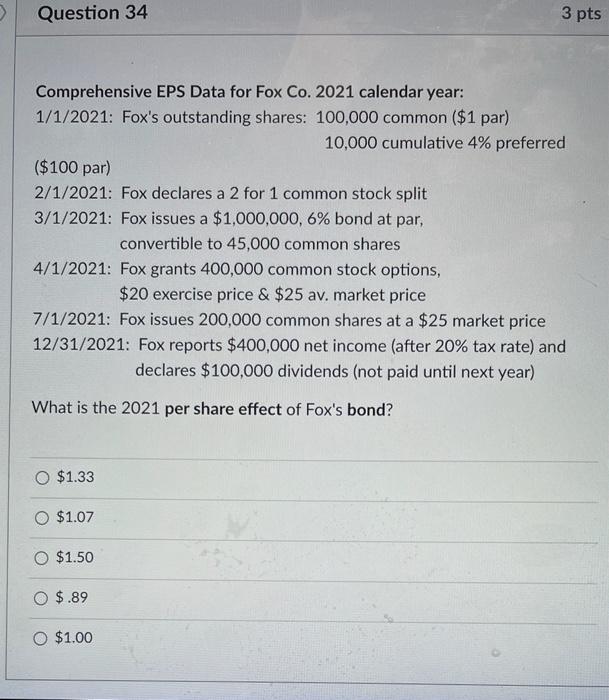

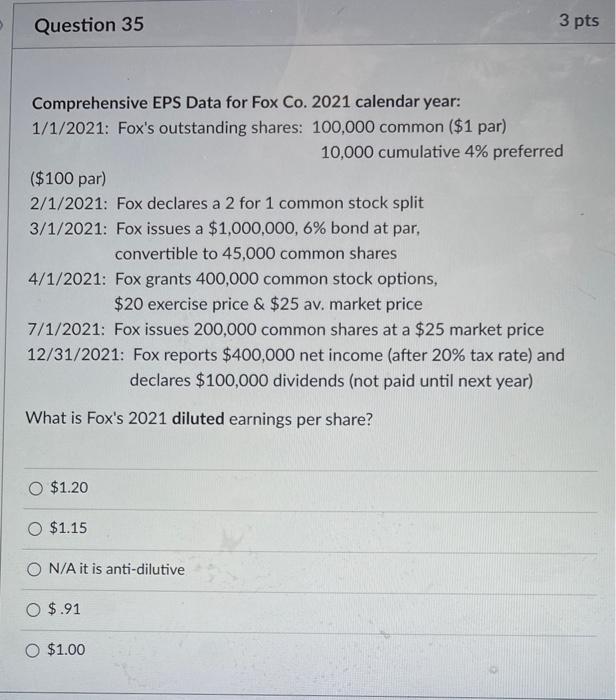

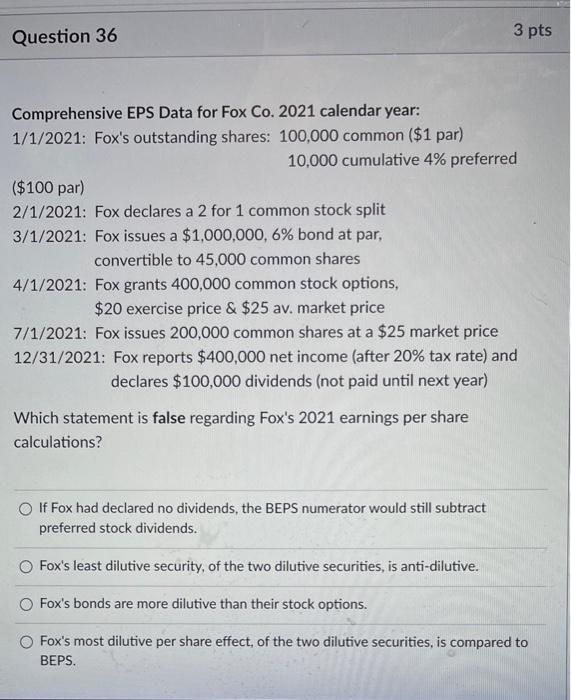

Question 33 3 pts Comprehensive EPS Data for Fox Co. 2021 calendar year: 1/1/2021: Fox's outstanding shares: 100,000 common ($1 par) 10,000 cumulative 4% preferred ($100 par) 2/1/2021: Fox declares a 2 for 1 common stock split 3/1/2021: Fox issues a $1,000,000, 6% bond at par, convertible to 45,000 common shares 4/1/2021: Fox grants 400,000 common stock options, $20 exercise price & $25 av, market price 7/1/2021: Fox issues 200,000 common shares at a $25 market price 12/31/2021: Fox reports $400,000 net income (after 20% tax rate) and declares $100,000 dividends (not paid until next year) What is the denominator amount for the per share effect of Fox's 2021 stock options? Zero 400,000 300,000 80,000 60,000 Question 34 3 pts Comprehensive EPS Data for Fox Co. 2021 calendar year: 1/1/2021: Fox's outstanding shares: 100,000 common ($1 par) 10,000 cumulative 4% preferred ($100 par) 2/1/2021: Fox declares a 2 for 1 common stock split 3/1/2021: Fox issues a $1,000,000, 6% bond at par, convertible to 45,000 common shares 4/1/2021: Fox grants 400,000 common stock options, $20 exercise price & $25 av, market price 7/1/2021: Fox issues 200,000 common shares at a $25 market price 12/31/2021: Fox reports $400,000 net income (after 20% tax rate) and declares $100,000 dividends (not paid until next year) What is the 2021 per share effect of Fox's bond? O $1.33 $1.07 O $1.50 O $.89 O $1.00 Question 35 3 pts Comprehensive EPS Data for Fox Co. 2021 calendar year: 1/1/2021: Fox's outstanding shares: 100,000 common ($1 par) 10,000 cumulative 4% preferred ($100 par) 2/1/2021: Fox declares a 2 for 1 common stock split 3/1/2021: Fox issues a $1,000,000, 6% bond at par, convertible to 45,000 common shares 4/1/2021: Fox grants 400,000 common stock options, $20 exercise price & $25 av, market price 7/1/2021: Fox issues 200,000 common shares at a $25 market price 12/31/2021: Fox reports $400,000 net income (after 20% tax rate) and declares $100,000 dividends (not paid until next year) What is Fox's 2021 diluted earnings per share? $1.20 O $1.15 O N/A it is anti-dilutive O $.91 $1.00 Question 36 3 pts Comprehensive EPS Data for Fox Co. 2021 calendar year: 1/1/2021: Fox's outstanding shares: 100,000 common ($1 par) 10,000 cumulative 4% preferred ($100 par) 2/1/2021: Fox declares a 2 for 1 common stock split 3/1/2021: Fox issues a $1,000,000, 6% bond at par, convertible to 45,000 common shares 4/1/2021: Fox grants 400,000 common stock options, $20 exercise price & $25 av, market price 7/1/2021: Fox issues 200,000 common shares at a $25 market price 12/31/2021: Fox reports $400,000 net income (after 20% tax rate) and declares $100,000 dividends (not paid until next year) Which statement is false regarding Fox's 2021 earnings per share calculations? If Fox had declared no dividends, the BEPS numerator would still subtract preferred stock dividends. Fox's least dilutive security, of the two dilutive securities, is anti-dilutive. Fox's bonds are more dilutive than their stock options. Fox's most dilutive per share effect, of the two dilutive securities, is compared to BEPS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts