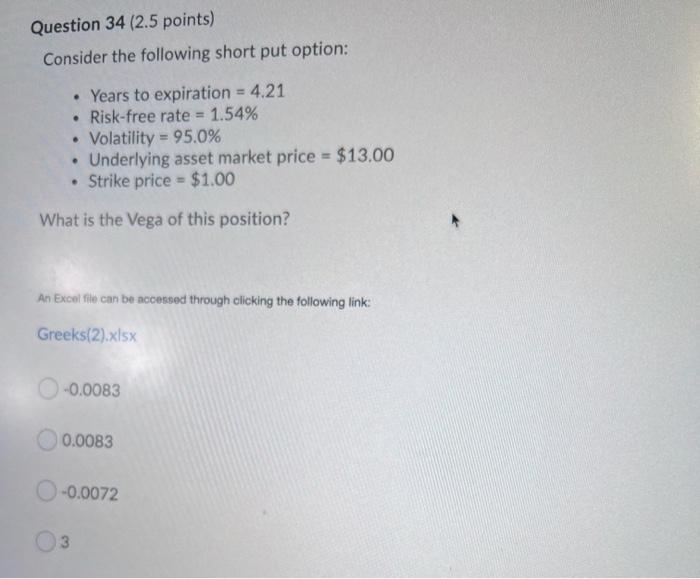

Question: Question 34 (2.5 points) Consider the following short put option: Years to expiration = 4.21 Risk-free rate = 1.54% Volatility = 95.0% Underlying asset market

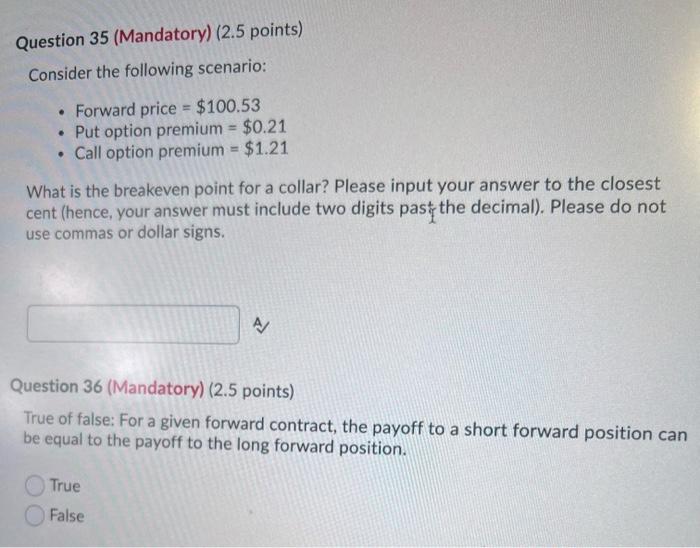

Question 34 (2.5 points) Consider the following short put option: Years to expiration = 4.21 Risk-free rate = 1.54% Volatility = 95.0% Underlying asset market price = $13.00 Strike price = $1.00 . . What is the Vega of this position? An Excel file can be accessed through clicking the following link: Greeks(2).xlsx -0.0083 0.0083 -0.0072 Question 35 (Mandatory) (2.5 points) Consider the following scenario: Forward price = $100.53 Put option premium = $0.21 Call option premium = $1.21 What is the breakeven point for a collar? Please input your answer to the closest cent (hence, your answer must include two digits past the decimal). Please do not use commas or dollar signs. A Question 36 (Mandatory) (2.5 points) True of false: For a given forward contract, the payoff to a short forward position can be equal to the payoff to the long forward position. True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts