Question: QUESTION 34 VMK Inc. is considering two projects. Assuming that Projects Apple3 and Banana4 are mutually exclusive, which recommendation may be the most reasonable for

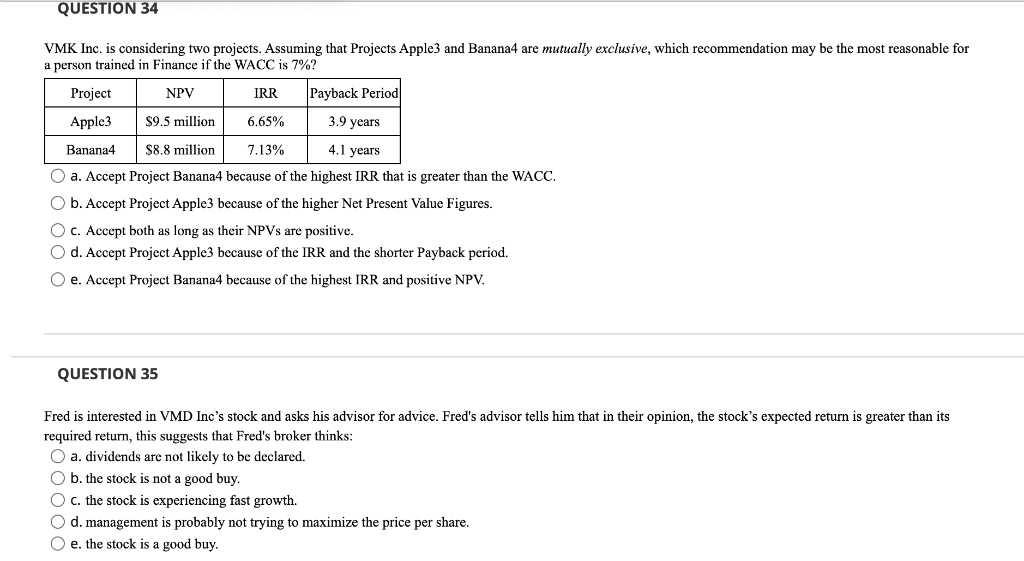

QUESTION 34 VMK Inc. is considering two projects. Assuming that Projects Apple3 and Banana4 are mutually exclusive, which recommendation may be the most reasonable for a person trained in Finance if the WACC is 7%? Project NPV IRR Payback Period Apple3 $9.5 million 6,65% 3.9 years Banana4 $8.8 million 7.13% 4.1 years O a. Accept Project Banana4 because of the highest IRR that is greater than the WACC. O b. Accept Project Apple3 because of the higher Net Present Value Figures. O c. Accept both as long as their NPVs are positive. Od. Accept Project Apple3 because of the IRR and the shorter Payback period. Oe. Accept Project Banana4 because of the highest IRR and positive NPV. QUESTION 35 Fred is interested in VMD Inc's stock and asks his advisor for advice. Fred's advisor tells him that in their opinion, the stock's expected return is greater than its required return, this suggests that Fred's broker thinks: O a. dividends are not likely to be declared. O b. the stock is not a good buy. OC. the stock is experiencing fast growth. O d. management is probably not trying to maximize the price per share. e. the stock is a good buy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts