Question: SS Inc. is considering two projects. Assuming that Projects Aliga and Bogata are mutually exclusive, which recommendation may be the most reasonable for a person

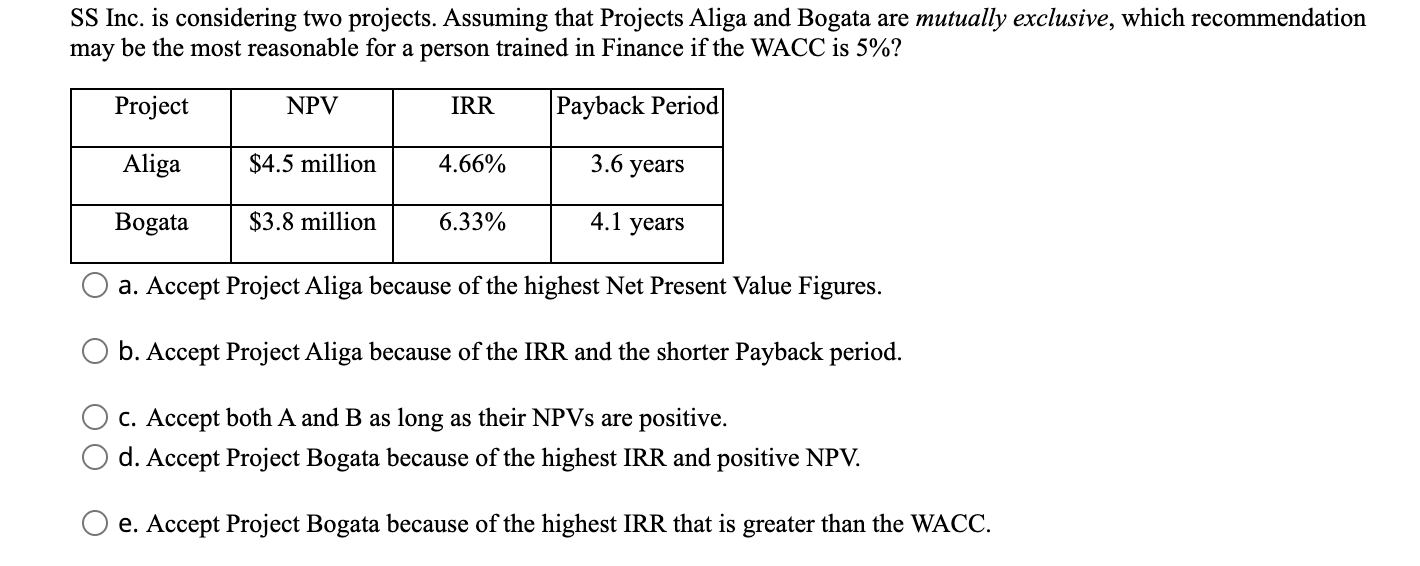

SS Inc. is considering two projects. Assuming that Projects Aliga and Bogata are mutually exclusive, which recommendation may be the most reasonable for a person trained in Finance if the WACC is 5%? Project NPV IRR Payback Period Aliga $4.5 million 4.66% 3.6 years Bogata $3.8 million 6.33% 4.1 years a. Accept Project Aliga because of the highest Net Present Value Figures. b. Accept Project Aliga because of the IRR and the shorter Payback period. C. Accept both A and B as long as their NPVs are positive. d. Accept Project Bogata because of the highest IRR and positive NPV. e. Accept Project Bogata because of the highest IRR that is greater than the WACC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts