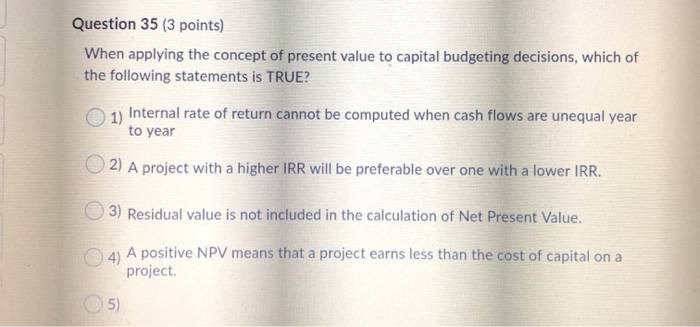

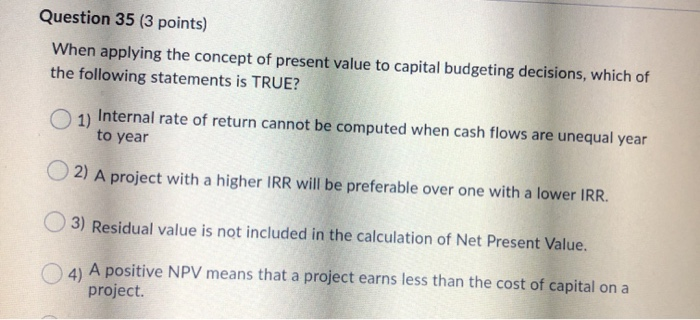

Question: Question 35 (3 points) When applying the concept of present value to capital budgeting decisions, which of the following statements is TRUE? 1) Internal rate

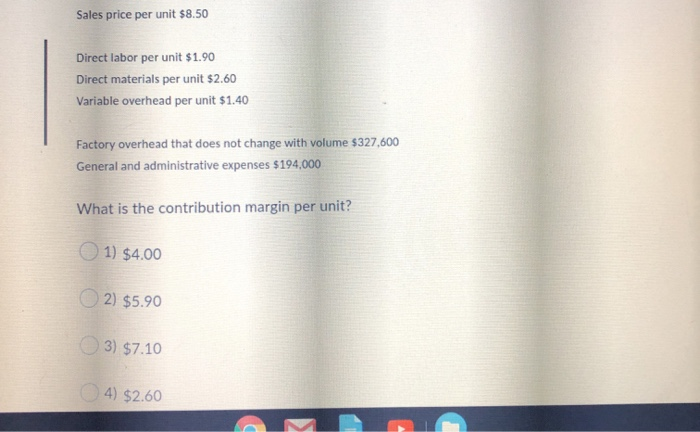

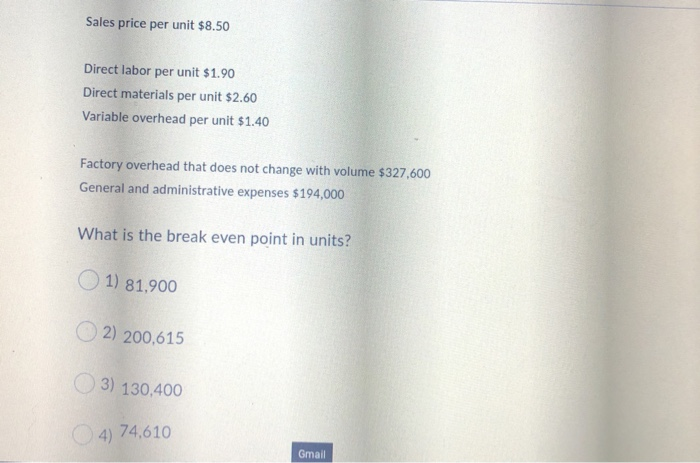

Question 35 (3 points) When applying the concept of present value to capital budgeting decisions, which of the following statements is TRUE? 1) Internal rate of return cannot be computed when cash flows are unequal year to year 2) A project with a higher IRR will be preferable over one with a lower IRR. 3) Residual value is not included in the calculation of Net Present Value. 4) A positive NPV means that a project earns less than the cost of capital on a project 5) Sales price per unit $8.50 Direct labor per unit $1.90 Direct materials per unit $2.60 Variable overhead per unit $1.40 Factory overhead that does not change with volume $327,600 General and administrative expenses $194,000 What is the contribution margin per unit? 1) $4.00 2) $5.90 3) $7.10 4) $2.60 Sales price per unit $8.50 Direct labor per unit $1.90 Direct materials per unit $2.60 Variable overhead per unit $1.40 Factory overhead that does not change with volume $327,600 General and administrative expenses $194,000 What is the break even point in units? 1) 81,900 2) 200,615 3) 130,400 4) 74,610 Gmail Question 35 (3 points) When applying the concept of present value to capital budgeting decisions, which of the following statements is TRUE? 1) Internal rate of return cannot be computed when cash flows are unequal year to year O2) A project with a higher IRR will be preferable over one with a lower IRR. 3) Residual value is not included in the calculation of Net Present Value. 4) A positive NPV means that a project earns less than the cost of capital on a project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts