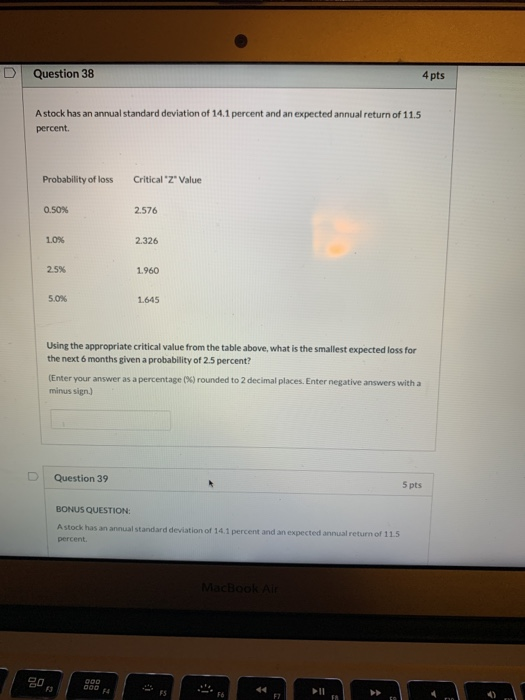

Question: Question 38 4 pts Astock has an annual standard deviation of 14.1 percent and an expected annual return of 11.5 percent. Probability of loss CriticalZ

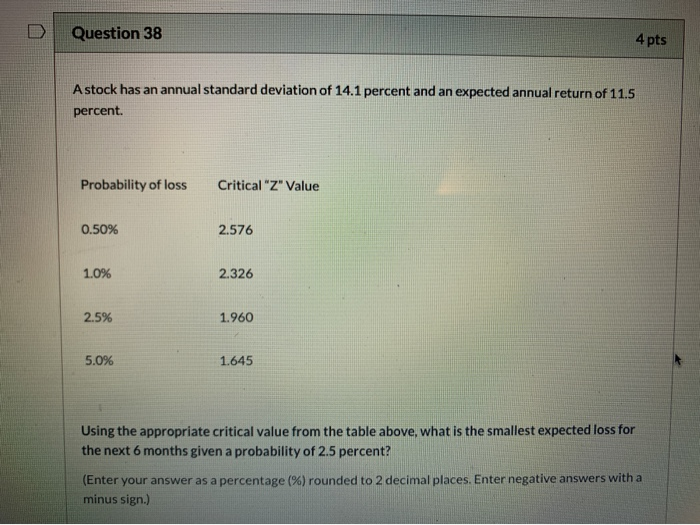

Question 38 4 pts Astock has an annual standard deviation of 14.1 percent and an expected annual return of 11.5 percent. Probability of loss Critical"Z" Value 0.50% 2.576 1.0% 2.326 25% 1.960 5.0% 1.645 Using the appropriate critical value from the table above, what is the smallest expected loss for the next 6 months given a probability of 2.5 percent? (Enter your answer as a percentage (%) rounded to 2 decimal places. Enter negative answers with a minus sign.) Question 39 5 pts BONUS QUESTION A stock has an annual standard deviation percent percent and an expected annual return of 115 D Question 38 4 pts Astock has an annual standard deviation of 14.1 percent and an expected annual return of 11.5 percent Probability of loss Critical "Z" Value 0.50% 2.576 1.0% 2.326 2.5% 1.960 5.0% 1.645 Using the appropriate critical value from the table above, what is the smallest expected loss for the next 6 months given a probability of 2.5 percent? (Enter your answer as a percentage (%) rounded to 2 decimal places. Enter negative answers with a minus sign.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts