Question: Question 38 of 75 When determining whether an activity is carried on for profit, the IRS will presume that it is engaged in for profit

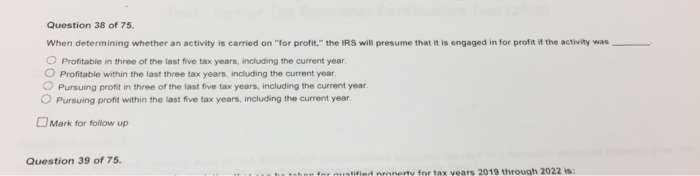

Question 38 of 75 When determining whether an activity is carried on "for profit," the IRS will presume that it is engaged in for profit if the activity was Profitable in three of the last five tax years, including the current year O Profitable within the last three tax years, including the current year. Pursuing profit in three of the last five tax years, including the current year O Pursuing profit within the last five tax years, including the current year. Mark for follow up Question 39 of 75. find nennenty for tax years 2019 through 2022 is

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock