Question: Question 383 pts You're advising a client whose regular salary is $120,000 before tax. In the 2021/2022 financial year, your client has earned an additional

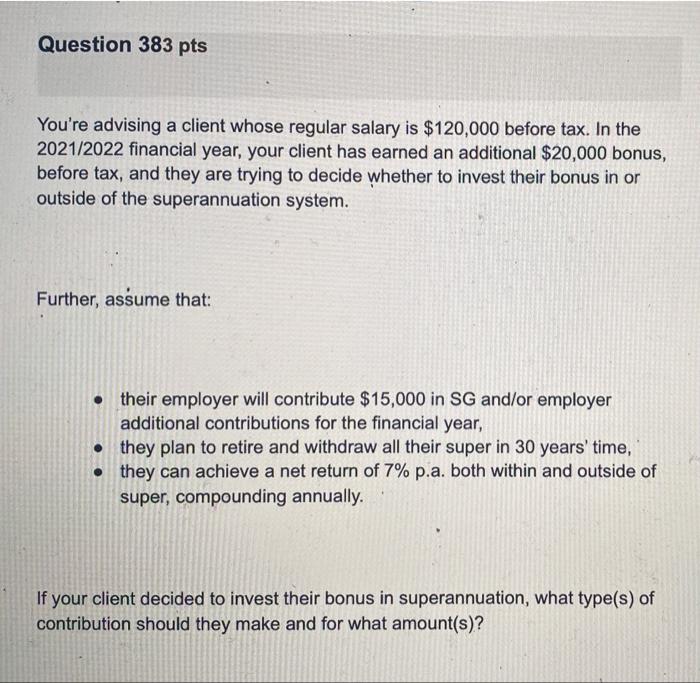

Question 383 pts You're advising a client whose regular salary is $120,000 before tax. In the 2021/2022 financial year, your client has earned an additional $20,000 bonus, before tax, and they are trying to decide whether to invest their bonus in or outside of the superannuation system. Further, assume that: their employer will contribute $15,000 in SG and/or employer additional contributions for the financial year, they plan to retire and withdraw all their super in 30 years' time, they can achieve a net return of 7% p.a. both within and outside of super, compounding annually. If your client decided to invest their bonus in superannuation, what type(s) of contribution should they make and for what amount(s)? Question 383 pts You're advising a client whose regular salary is $120,000 before tax. In the 2021/2022 financial year, your client has earned an additional $20,000 bonus, before tax, and they are trying to decide whether to invest their bonus in or outside of the superannuation system. Further, assume that: their employer will contribute $15,000 in SG and/or employer additional contributions for the financial year, they plan to retire and withdraw all their super in 30 years' time, they can achieve a net return of 7% p.a. both within and outside of super, compounding annually. If your client decided to invest their bonus in superannuation, what type(s) of contribution should they make and for what amount(s)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts