Question: Question 3-Taxable Equivalent Yield Jack & Jill are a young married couple residing in Connecticut. Their Federal marginal tax rate is 22.0%; their Connecticut

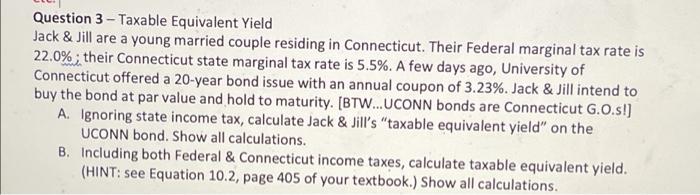

Question 3-Taxable Equivalent Yield Jack & Jill are a young married couple residing in Connecticut. Their Federal marginal tax rate is 22.0%; their Connecticut state marginal tax rate is 5.5%. A few days ago, University of Connecticut offered a 20-year bond issue with an annual coupon of 3.23%. Jack & Jill intend to buy the bond at par value and hold to maturity. [BTW... UCONN bonds are Connecticut G.O.s!] A. Ignoring state income tax, calculate Jack & Jill's "taxable equivalent yield" on the UCONN bond. Show all calculations. B. Including both Federal & Connecticut income taxes, calculate taxable equivalent yield. (HINT: see Equation 10.2, page 405 of your textbook.) Show all calculations.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts