Question: QUESTION 4 ( 1 5 MARKS ) ANTS Limited has submitted their inventory records for review and assistance with the tax calculations for the assessment

QUESTION

MARKS

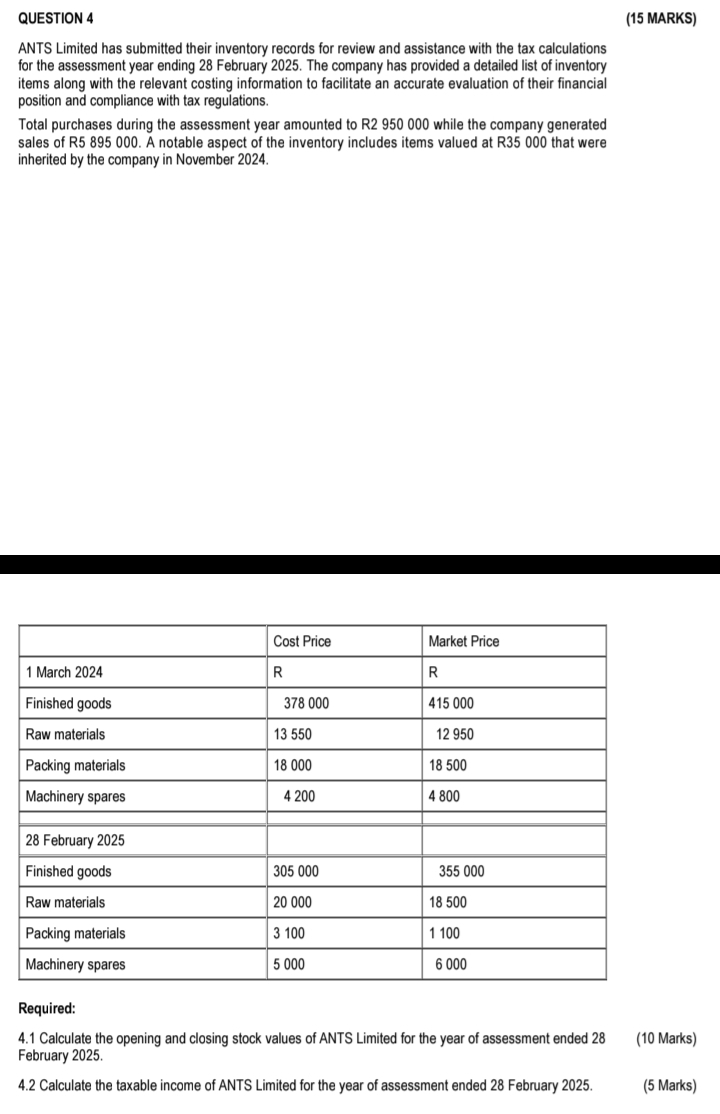

ANTS Limited has submitted their inventory records for review and assistance with the tax calculations for the assessment year ending February The company has provided a detailed list of inventory items along with the relevant costing information to facilitate an accurate evaluation of their financial position and compliance with tax regulations.

Total purchases during the assessment year amounted to R while the company generated sales of R A notable aspect of the inventory includes items valued at R that were inherited by the company in November

tableCost Price,Market Price March RRFinished goods,Raw materials,Packing materials,Machinery spares, February Finished goods,Raw materials,Packing materials,Machinery spares,

Required:

Calculate the opening and closing stock values of ANTS Limited for the year of assessment ended

Marks

February

Calculate the taxable income of ANTS Limited for the year of assessment ended February

Marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock