Question: QUESTION 4 ( 1 5 marks ) This question consists of two unrelated parts: PART A and PART B . PART A ( 9 marks

QUESTION

marks

This question consists of two unrelated parts: PART A and PART B

PART A

marks

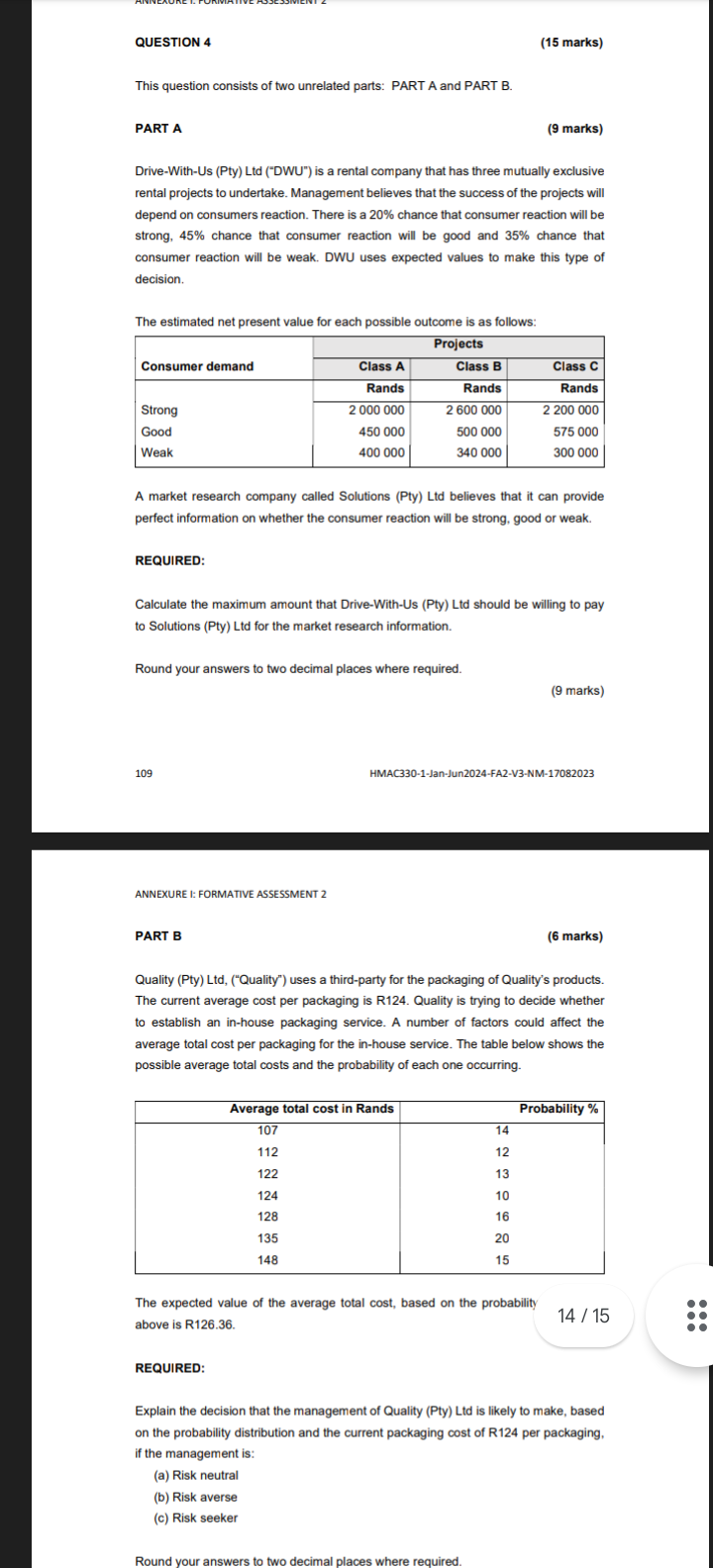

DriveWithUs Pty Ltd DWU is a rental company that has three mutually exclusive rental projects to undertake. Management believes that the success of the projects will depend on consumers reaction. There is a chance that consumer reaction will be strong, chance that consumer reaction will be good and chance that consumer reaction will be weak. DWU uses expected values to make this type of decision,

The estimated net present value for each possible outcome is as follows:

tableConsumer demand,ProjectsClass AClass BClass CStrongRands,Rands,Rands

A market research company called Solutions Pty Ltd believes that it can provide perfect information on whether the consumer reaction will be strong, good or weak.

REQUIRED:

Calculate the maximum amount that DriveWithUs Pty Ltd should be willing to pay to Solutions Pty Ltd for the market research information.

Round your answers to two decimal places where required.

marks

HMACJanJunFAVNM

ANNEXURE I: FORMATIVE ASSESSMENT

PART B

marks

Quality Pty LtdQuality uses a thirdparty for the packaging of Quality's products. The current average cost per packaging is R Quality is trying to decide whether to establish an inhouse packaging service. A number of factors could affect the average total cost per packaging for the inhouse service. The table below shows the possible average total costs and the probability of each one occurring.

tableAverage total cost in Rands,Probability

The expected value of the average total cost, based on the probability above is

REQUIRED:

Explain the decision that the management of Quality Pty Ltd is likely to make, based on the probability distribution and the current packaging cost of R per packaging, if the management is:

a Risk neutral

b Risk averse

c Risk seeker

Round your answers to two decimal places where required.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock