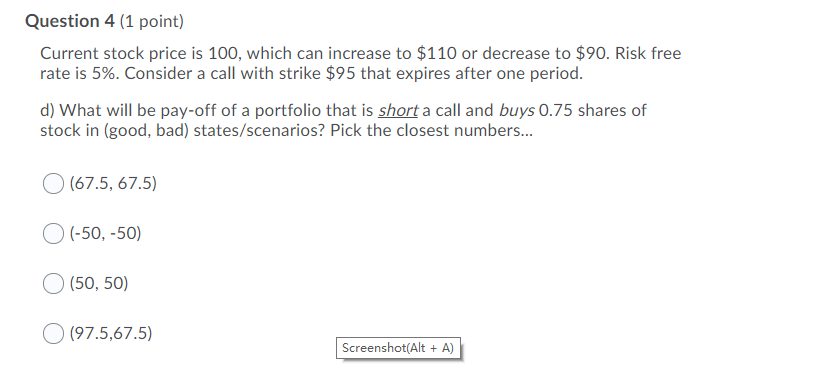

Question: Question 4 (1 point) Current stock price is 100, which can increase to $110 or decrease to $90. Risk free rate is 5%. Consider a

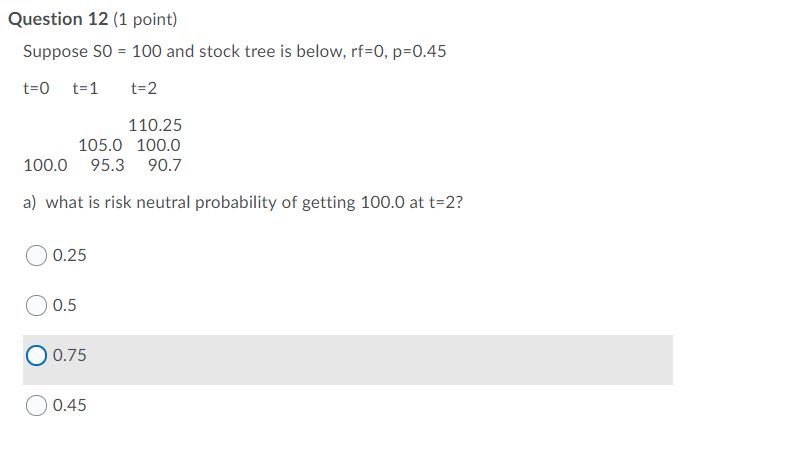

Question 4 (1 point) Current stock price is 100, which can increase to $110 or decrease to $90. Risk free rate is 5%. Consider a call with strike $95 that expires after one period. d) What will be pay-off of a portfolio that is short a call and buys 0.75 shares of stock in (good, bad) states/scenarios? Pick the closest numbers... O (67.5, 67.5) O(-50, -50) (50, 50) O (97.5,67.5) Screenshot(Alt + A) Question 12 (1 point) Suppose SO = 100 and stock tree is below, rf=0, p=0.45 t=0 t=1 t=2 110.25 105.0 100.0 95.3 90.7 100.0 a) what is risk neutral probability of getting 100.0 at t=2? O 0.25 O 0.5 O 0.75 0.45

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock