Question: Question 4 (12 points) In class we discussed the types of cash flows received by bondholders when they invest in corporate bonds. From the financial

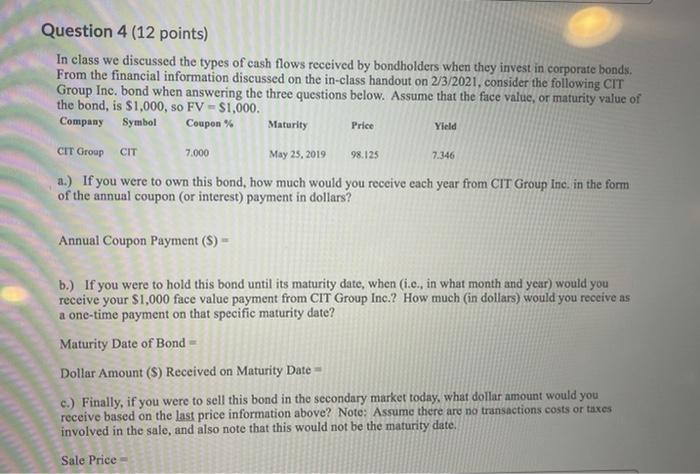

Question 4 (12 points) In class we discussed the types of cash flows received by bondholders when they invest in corporate bonds. From the financial information discussed on the in-class handout on 2/3/2021, consider the following CIT Group Inc. bond when answering the three questions below. Assume that the face value, or maturity value of the bond, is $1,000, so FV - $1,000. Company Symbol Coupon % % Maturity CIT Group CIT 7.000 May 25, 2019 a.) If you were to own this bond, how much would you receive each year from CIT Group Inc. in the form of the annual coupon (or interest) payment in dollars? Price Yield 98.125 7.346 Annual Coupon Payment ($) -- b.) If you were to hold this bond until its maturity date, when (i.c., in what month and year) would you receive your $1,000 face value payment from CIT Group Inc.? How much (in dollars) would you receive as a one-time payment on that specific maturity date? Maturity Date of Bond Dollar Amount (S) Received on Maturity Date - c.) Finally, if you were to sell this bond in the secondary market today, what dollar amount would you receive based on the last price information above? Note: Assume there are no transactions costs or taxes involved in the sale, and also note that this would not be the maturity date. Sale Price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts