Question: Financial forecasts are the basis for equity valuation based on and/or market multiples. An analyst begins with a review of the company and its environment,

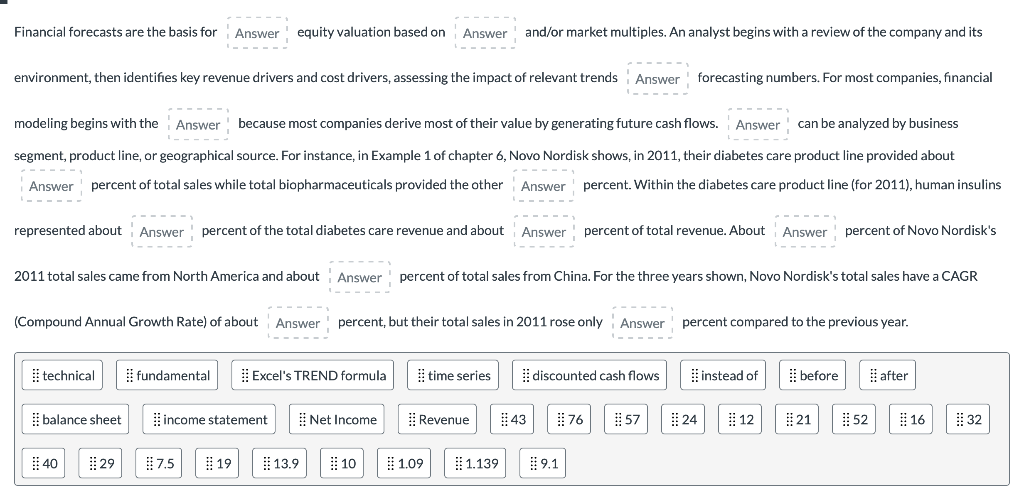

Financial forecasts are the basis for equity valuation based on and/or market multiples. An analyst begins with a review of the company and its environment, then identifies key revenue drivers and cost drivers, assessing the impact of relevant trends forecasting numbers. For most companies, financial modeling begins with the because most companies derive most of their value by generating future cash flows. can be analyzed by business segment, product line, or geographical source. For instance, in Example 1 of chapter 6, Novo Nordisk shows, in 2011, their diabetes care product line provided about percent of total sales while total biopharmaceuticals provided the other percent. Within the diabetes care product line (for 2011), human insulins represented about percent of the total diabetes care revenue and about percent of total revenue. About percent of Novo Nordisk's 2011 total sales came from North America and about percent of total sales from China. For the three years shown, Novo Nordisk's total sales have a CAGR (Compound Annual Growth Rate) of about percent, but their total sales in 2011 rose only percent compared to the previous year. Financial forecasts are the basis for equity valuation based on and/or market multiples. An analyst begins with a review of the company and its environment, then identifies key revenue drivers and cost drivers, assessing the impact of relevant trends forecasting numbers. For most companies, financial modeling begins with the because most companies derive most of their value by generating future cash flows. can be analyzed by business segment, product line, or geographical source. For instance, in Example 1 of chapter 6, Novo Nordisk shows, in 2011, their diabetes care product line provided about percent of total sales while total biopharmaceuticals provided the other percent. Within the diabetes care product line (for 2011), human insulins represented about percent of the total diabetes care revenue and about percent of total revenue. About percent of Novo Nordisk's 2011 total sales came from North America and about percent of total sales from China. For the three years shown, Novo Nordisk's total sales have a CAGR (Compound Annual Growth Rate) of about percent, but their total sales in 2011 rose only percent compared to the previous year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts