Question: Question 4 (13 points) a) The following table lists some prices of options on common stocks. The interest rate is 10 percent a year. Can

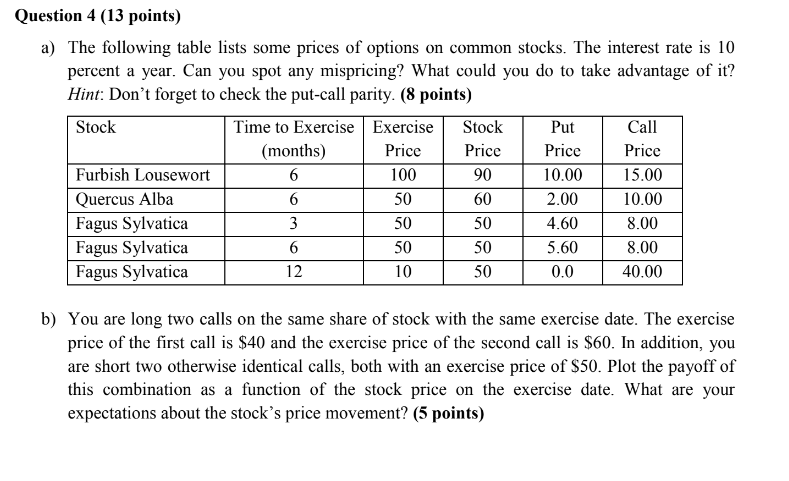

Question 4 (13 points) a) The following table lists some prices of options on common stocks. The interest rate is 10 percent a year. Can you spot any mispricing? What could you do to take advantage of it? Hint: Don't forget to check the put-call parity. (8 points) Call Price 15.00 10.00 8.00 8.00 40.00 Stock Time to Exercise| Exercise Stock Put (months) Furbish Lousewort Quercus Alba Fagus Sylvatica Fagus Sylvatica Fagus Sylvatica Price 100 50 50 50 10 Price 90 60 50 50 50 10.00 2.00 4.60 5.60 0.0 12 b) You are long two calls on the same share of stock with the same exercise date. The exercise price of the first call is $40 and the exercise price of the second call is $60. In addition, yoiu are short two otherwise identical calls, both with an exercise price of S50. Plot the payoff of this combination as a function of the stock price on the exercise date. What are your expectations about the stock's price movement? (5 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts