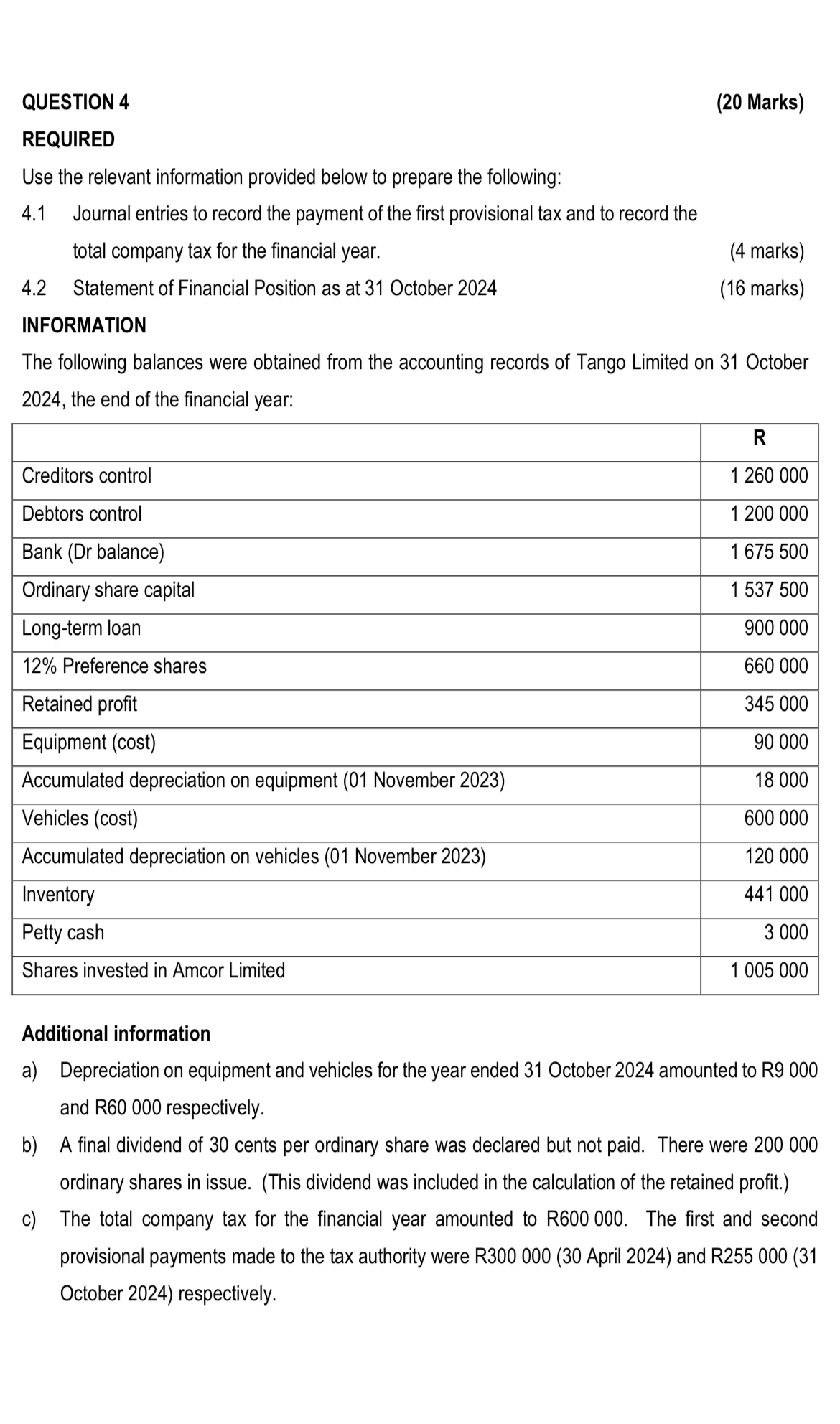

Question: QUESTION 4 ( 2 0 Marks ) REQUIRED Use the relevant information provided below to prepare the following: 4 . 1 Journal entries to record

QUESTION

Marks

REQUIRED

Use the relevant information provided below to prepare the following:

Journal entries to record the payment of the first provisional tax and to record the total company tax for the financial year.

marks

Statement of Financial Position as at October

marks

INFORMATION

The following balances were obtained from the accounting records of Tango Limited on October the end of the financial year:

tableRCreditors control,Debtors control,Bank Dr balanceOrdinary share capital,Longterm loan, Preference shares,Retained profit,Equipment costAccumulated depreciation on equipment November Vehicles costAccumulated depreciation on vehicles November InventoryPetty cash,Shares invested in Amcor Limited,

Additional information

a Depreciation on equipment and vehicles for the year ended October amounted to R and R respectively.

b A final dividend of cents per ordinary share was declared but not paid. There were ordinary shares in issue. This dividend was included in the calculation of the retained profit.

c The total company tax for the financial year amounted to R The first and second provisional payments made to the tax authority were R April and R October respectively.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock