Question: QUESTION 4 (20 Marks) REQUIRED Use the relevant information provided below to prepare the following: 4.1 Journal entries to record the interim dividend paid and

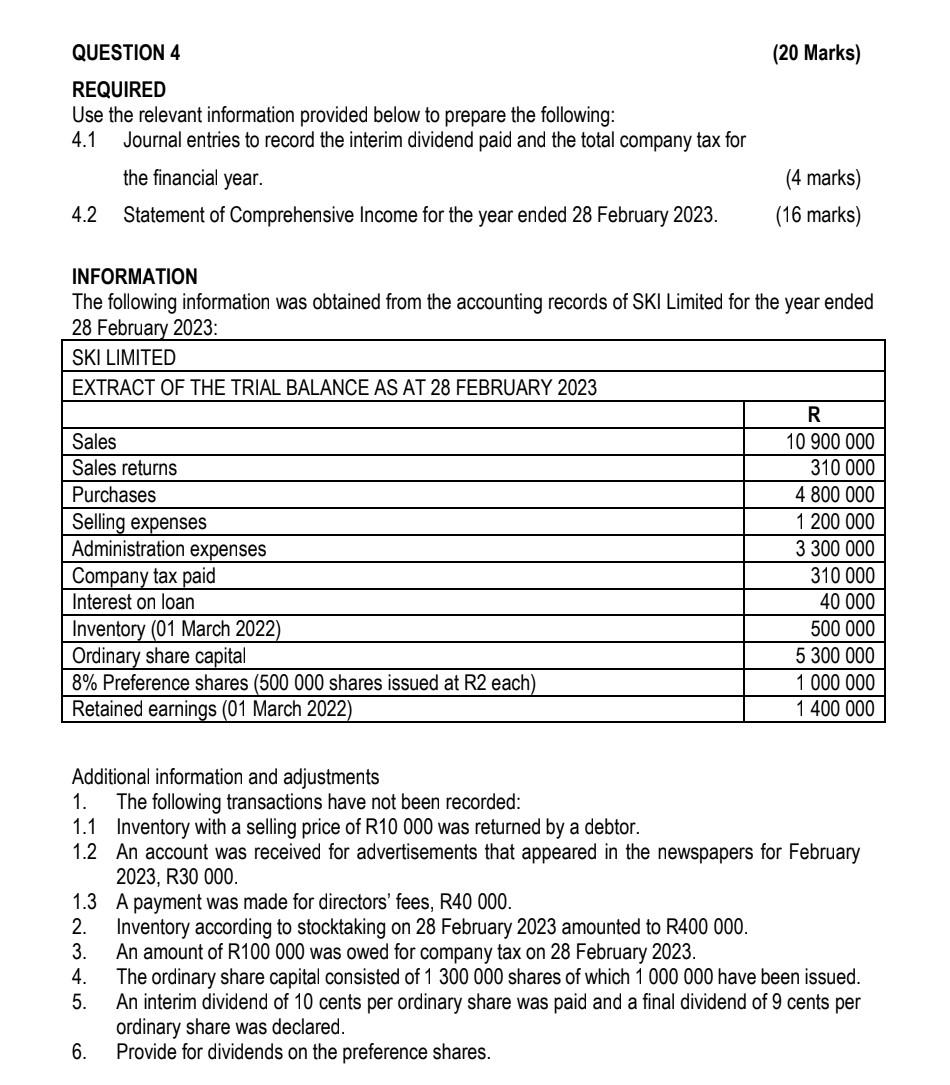

QUESTION 4 (20 Marks) REQUIRED Use the relevant information provided below to prepare the following: 4.1 Journal entries to record the interim dividend paid and the total company tax for the financial year. (4 marks) 4.2 Statement of Comprehensive Income for the year ended 28 February 2023. (16 marks) INFORMATION The following information was obtained from the accounting records of SKI Limited for the year ended 28 Fahruan, 3032 . Additional information and adjustments 1. The following transactions have not been recorded: 1.1 Inventory with a selling price of R10 000 was returned by a debtor. 1.2 An account was received for advertisements that appeared in the newspapers for February 2023, R30 000. 1.3 A payment was made for directors' fees, R40 000 . 2. Inventory according to stocktaking on 28 February 2023 amounted to R400 000 . 3. An amount of R100 000 was owed for company tax on 28 February 2023. 4. The ordinary share capital consisted of 1300000 shares of which 1000000 have been issued. 5. An interim dividend of 10 cents per ordinary share was paid and a final dividend of 9 cents per ordinary share was declared. 6. Provide for dividends on the preference shares

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts