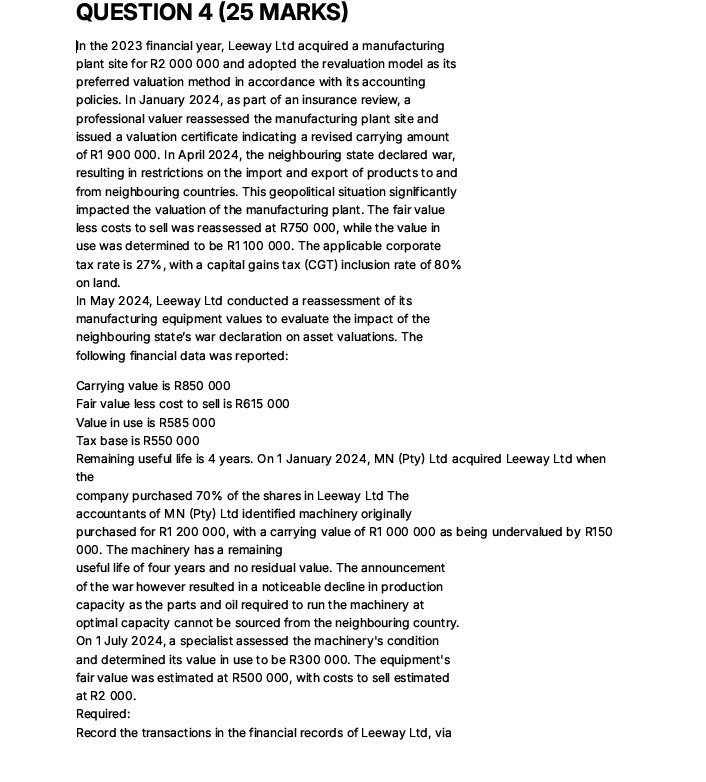

Question: QUESTION 4 ( 2 5 MARKS ) In the 2 0 2 3 financial year, Leeway Ltd acquired a manufacturing plant site for R 2

QUESTION MARKS In the financial year, Leeway Ltd acquired a manufacturing plant site for R and adopted the revaluation model as its preferred valuation method in accordance with its accounting policies. In January as part of an insurance review, a professional valuer reassessed the manufacturing plant site and issued a valuation certificate indicating a revised carrying amount of R In April the neighbouring state declared war, resulting in restrictions on the import and export of products to and from neighbouring countries. This geopolitical situation significantly impacted the valuation of the manufacturing plant. The fair value less costs to sell was reassessed at R while the value in use was determined to be R The applicable corporate tax rate is with a capital gains tax CGT inclusion rate of on land. In May Leeway Ltd conducted a reassessment of its manufacturing equipment values to evaluate the impact of the neighbouring state's war declaration on asset valuations. The following financial data was reported: Carrying value is R Fair value less cost to sell is R Value in use is R Tax base is R Remaining useful life is years. On January MN Pty Ltd acquired Leeway Ltd when the company purchased of the shares in Leeway Ltd The accountants of MN Pty Ltd identified machinery originally purchased for R with a carrying value of R as being undervalued by R The machinery has a remaining useful life of four years and no residual value. The announcement of the war however resulted in a noticeable decline in production capacity as the parts and oil required to run the machinery at optimal capacity cannot be sourced from the neighbouring country. On July a specialist assessed the machinery's condition and determined its value in use to be R The equipment's fair value was estimated at R with costs to sell estimated at R Required: Record the transactions in the financial records of Leeway Ltd via general journal entries, for the financial year ended December

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock