Question: Question 4 (2 points): The Irish Co. is an all equity firm with a total value of $ 500 million and with a cost of

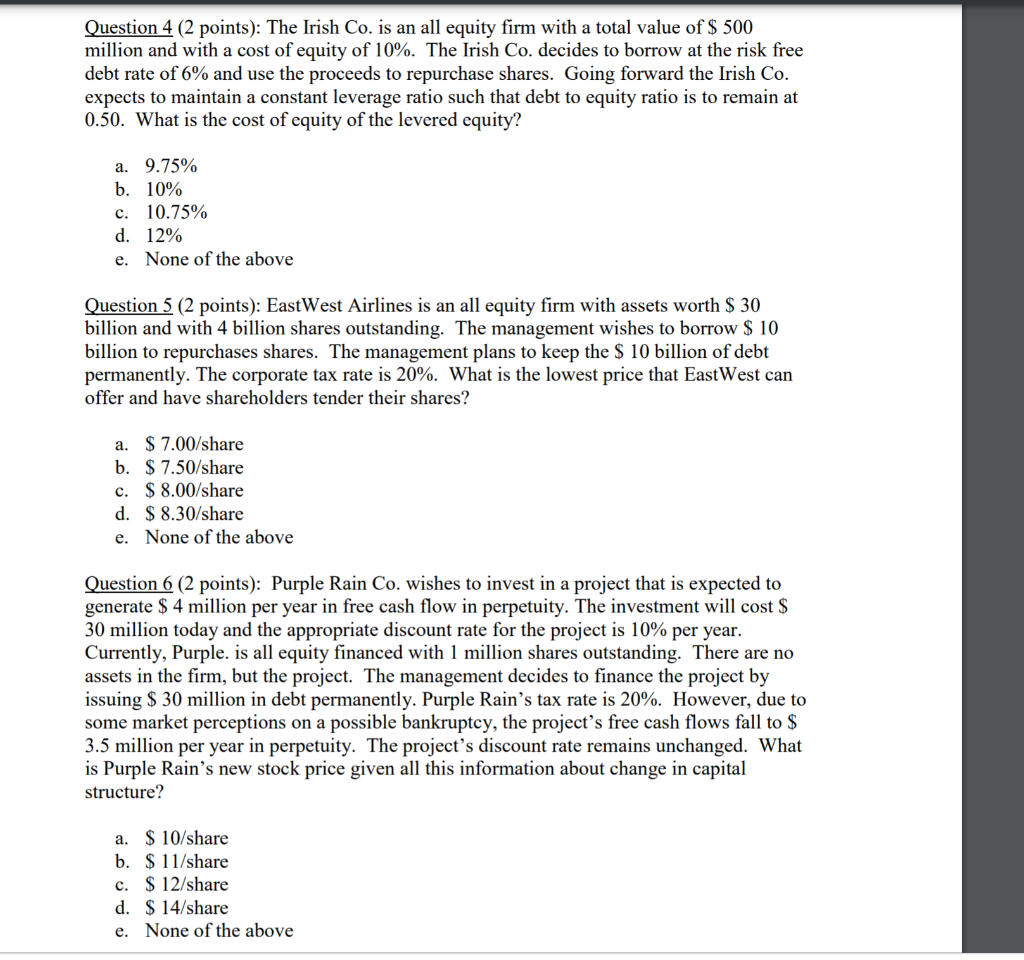

Question 4 (2 points): The Irish Co. is an all equity firm with a total value of $ 500 million and with a cost of equity of 10%. The Irish Co. decides to borrow at the risk free debt rate of 6% and use the proceeds to repurchase shares. Going forward the Irish Co. expects to maintain a constant leverage ratio such that debt to equity ratio is to remain at 0.50. What is the cost of equity of the levered equity? a. 9.75% b. 10% c. 10.75% d. 12% e. None of the above Question 5 (2 points): EastWest Airlines is an all equity firm with assets worth $ 30 billion and with 4 billion shares outstanding. The management wishes to borrow $ 10 billion to repurchases shares. The management plans to keep the $ 10 billion of debt permanently. The corporate tax rate is 20%. What is the lowest price that EastWest can offer and have shareholders tender their shares? a. $ 7.00/share b. $ 7.50/share c. $ 8.00/share d. $ 8.30/share e. None of the above Question 6 (2 points): Purple Rain Co. wishes to invest in a project that is expected to generate $ 4 million per year in free cash flow in perpetuity. The investment will cost $ 30 million today and the appropriate discount rate for the project is 10% per year. Currently, Purple. is all equity financed with 1 million shares outstanding. There are no assets in the firm, but the project. The management decides to finance the project by issuing $ 30 million in debt permanently. Purple Rain's tax rate is 20%. However, due to some market perceptions on a possible bankruptcy, the project's free cash flows fall to $ 3.5 million per year in perpetuity. The project's discount rate remains unchanged. What is Purple Rain's new stock price given all this information about change in capital structure? a. $ 10/share b. $ 11/share c. $ 12/share d. $ 14/share e. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts