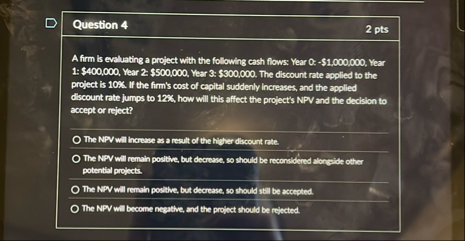

Question: Question 4 2 pts A firm is evcluating a project with the following cash flows: Year 0 : $ 1 , 0 0 0 ,

Question

pts

A firm is evcluating a project with the following cash flows: Year : $ Year : $ Year :$ Year :$ The discount rate applied to the project is If the firm's cost of capital suddenly increases, and the applied discount rate jumps to how will this affect the project's NPV and the declslon to accept or reject?

The NPV will incrase as a resalt of the hisher discount rite.

The NPV will remain poaltive, but decrease, so should be reconsideted slorenide other potention projects.

The NPV will remain poidive, but dearese, so should stil be accepted.

The NPV wil become negetive, and the propect should be reiected.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock