Question: Question 4 2 pts A sell-side analyst is valuing a public firm based on the following assumptions: Firm just paid a dividend of $1.00 Growth

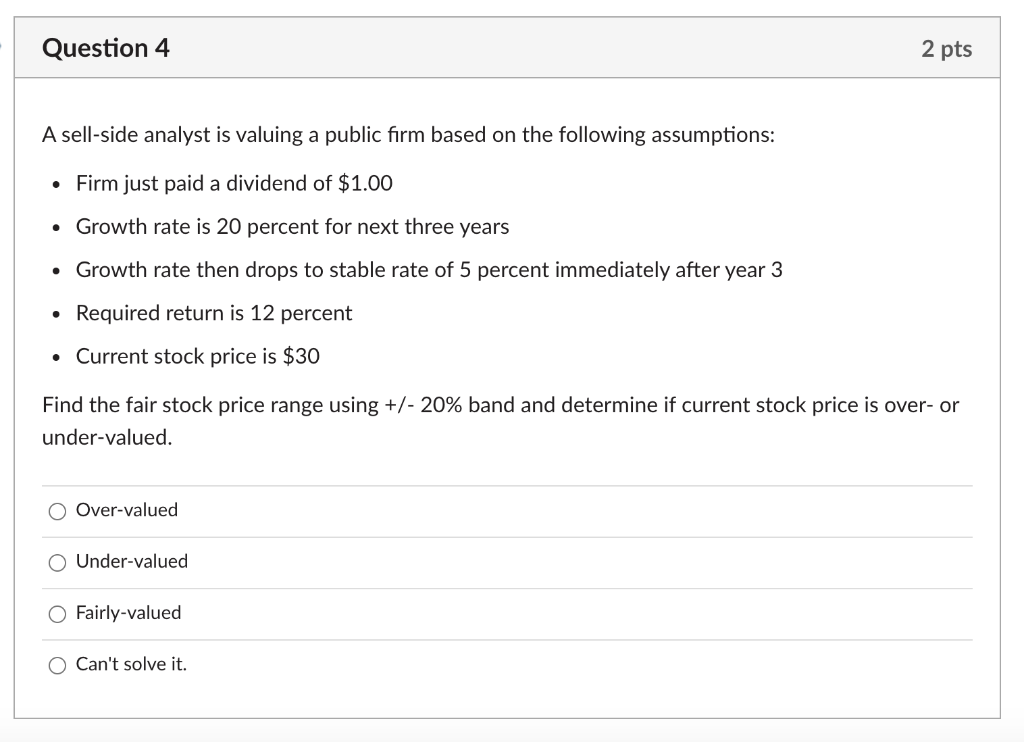

Question 4 2 pts A sell-side analyst is valuing a public firm based on the following assumptions: Firm just paid a dividend of $1.00 Growth rate is 20 percent for next three years Growth rate then drops to stable rate of 5 percent immediately after year 3 Required return is 12 percent Current stock price is $30 Find the fair stock price range using +/- 20% band and determine if current stock price is over- or under-valued. Over-valued Under-valued Fairly-valued Can't solve it

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts