Question: Question 4 - (20 Points) You are a broker and you think that the Google share price will rise in the next three months. The

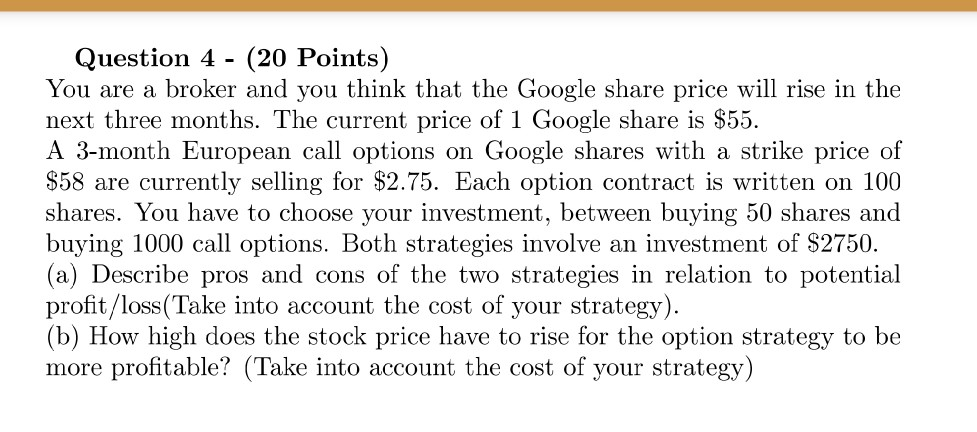

Question 4 - (20 Points) You are a broker and you think that the Google share price will rise in the next three months. The current price of 1 Google share is $55. A 3-month European call options on Google shares with a strike price $58 are currently selling for $2.75. Each option contract is written on 100 shares. You have to choose your investment, between buying 50 shares and buying 1000 call options. Both strategies involve an investment of $2750. (a) Describe pros and cons of the two strategies in relation to potential profit/loss (Take into account the cost of your strategy). (b) How high does the stock price have to rise for the option strategy to be more profitable? (Take into account the cost of your strategy)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts