Question: Question 4 (25 marks) Tom So is an analyst in Value Fund Company Limited which values dividend paying stocks by discounting the dividends over the

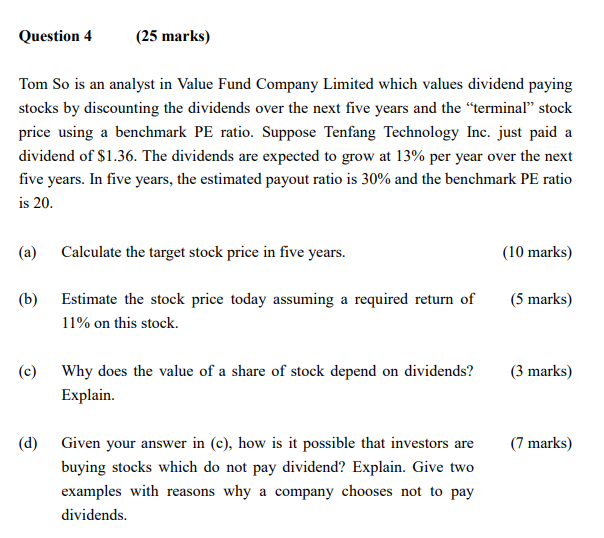

Question 4 (25 marks) Tom So is an analyst in Value Fund Company Limited which values dividend paying stocks by discounting the dividends over the next five years and the terminal stock price using a benchmark PE ratio. Suppose Tenfang Technology Inc. just paid a dividend of $1.36. The dividends are expected to grow at 13% per year over the next five years. In five years, the estimated payout ratio is 30% and the benchmark PE ratio is 20. (a) Calculate the target stock price in five years. (10 marks) (6) Estimate the stock price today assuming a required return of 11% on this stock. (5 marks) (c) (3 marks) Why does the value of a share of stock depend on dividends? Explain. (d) (7 marks) Given your answer in (c), how is it possible that investors are buying stocks which do not pay dividend? Explain. Give two examples with reasons why a company chooses not to pay dividends

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts