Question: Question 4 (25 points) (1) The following table shows the market prices for three treasury bonds with zero or semiannual coupon payments. Assume all bonds

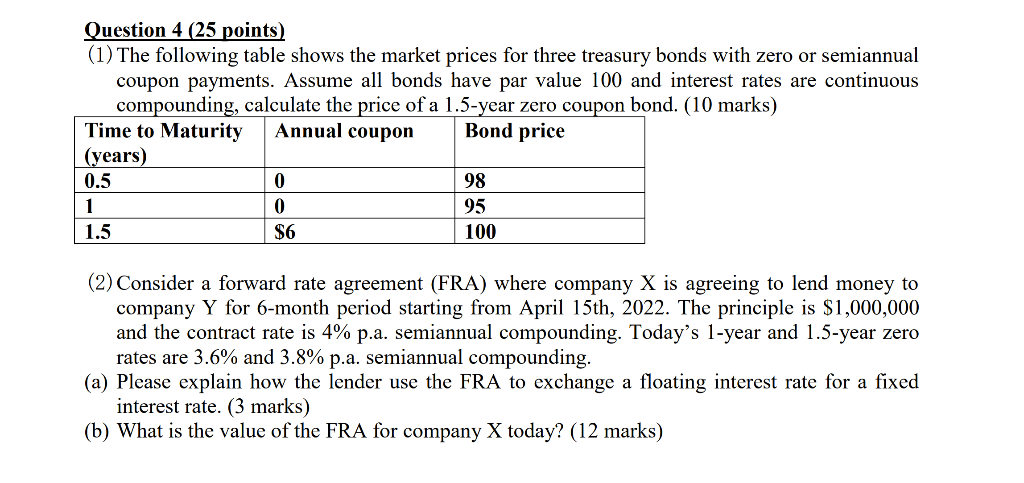

Question 4 (25 points) (1) The following table shows the market prices for three treasury bonds with zero or semiannual coupon payments. Assume all bonds have par value 100 and interest rates are continuous compounding, calculate the price of a 1.5-year zero coupon bond. (10 marks) Time to Maturity Annual coupon Bond price (years) 0.5 0 98 1 0 95 1.5 $6 100 (2) Consider a forward rate agreement (FRA) where company X is agreeing to lend money to company Y for 6-month period starting from April 15th, 2022. The principle is $1,000,000 and the contract rate is 4% p.a. semiannual compounding. Today's 1-year and 1.5-year zero rates are 3.6% and 3.8% p.a. semiannual compounding. (a) Please explain how the lender use the FRA to exchange a floating interest rate for a fixed interest rate. (3 marks) (b) What is the value of the FRA for company X today? (12 marks) Question 4 (25 points) (1) The following table shows the market prices for three treasury bonds with zero or semiannual coupon payments. Assume all bonds have par value 100 and interest rates are continuous compounding, calculate the price of a 1.5-year zero coupon bond. (10 marks) Time to Maturity Annual coupon Bond price (years) 0.5 0 98 1 0 95 1.5 $6 100 (2) Consider a forward rate agreement (FRA) where company X is agreeing to lend money to company Y for 6-month period starting from April 15th, 2022. The principle is $1,000,000 and the contract rate is 4% p.a. semiannual compounding. Today's 1-year and 1.5-year zero rates are 3.6% and 3.8% p.a. semiannual compounding. (a) Please explain how the lender use the FRA to exchange a floating interest rate for a fixed interest rate. (3 marks) (b) What is the value of the FRA for company X today? (12 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts