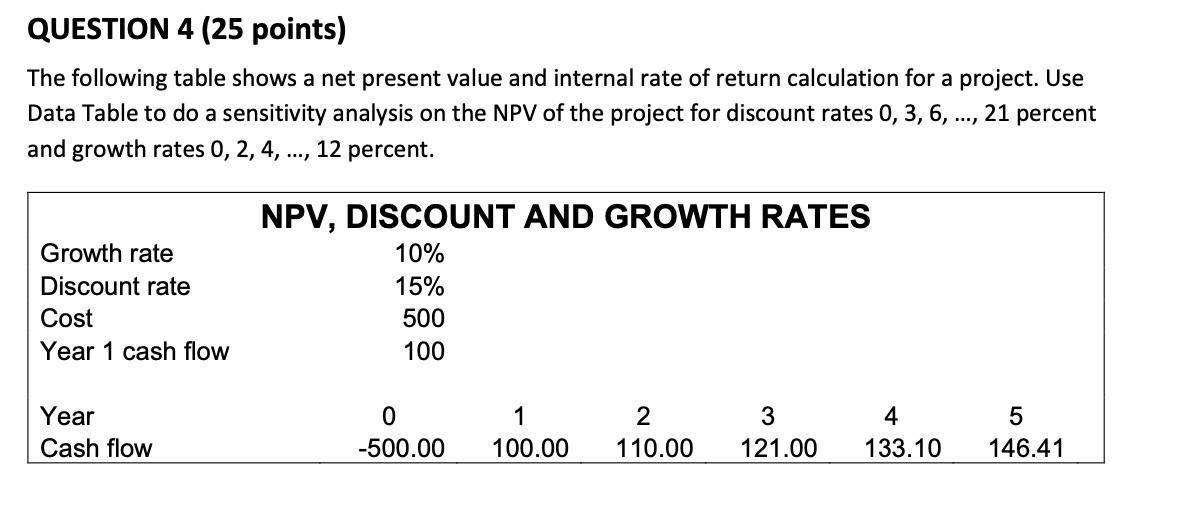

Question: QUESTION 4 (25 points) The following table shows a net present value and internal rate of return calculation for a project. Use Data Table to

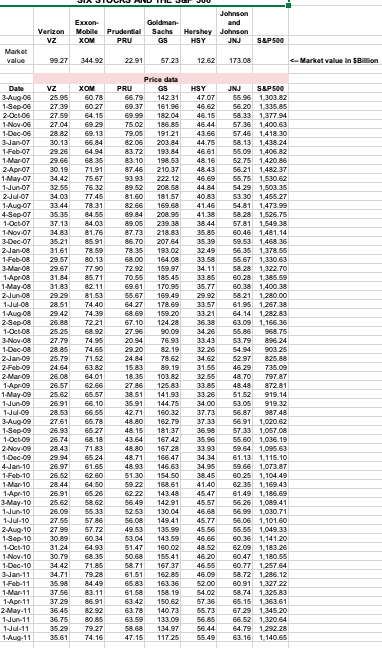

QUESTION 4 (25 points) The following table shows a net present value and internal rate of return calculation for a project. Use Data Table to do a sensitivity analysis on the NPV of the project for discount rates 0, 3, 6, ..., 21 percent and growth rates 0, 2, 4, ..., 12 percent. Growth rate Discount rate Cost Year 1 cash flow NPV, DISCOUNT AND GROWTH RATES 10% 15% 500 100 Year Cash flow 0 -500.00 1 100.00 2 110.00 3 121.00 4 133.10 5 146.41 DIA EXO Mobile Prudential XOM PRU Verizon VZ Johnson and Hershey Johnson HSY JNJ Goldman Sachs GS S&P 500 Market value 99.27 344 92 22.91 57 23 12.62 173.08

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts