Question: Question 4 (26 marks / Bond Market and Term Structure of Interest Rates) (a) The following table shows yields to maturity of U.S. Treasury securities

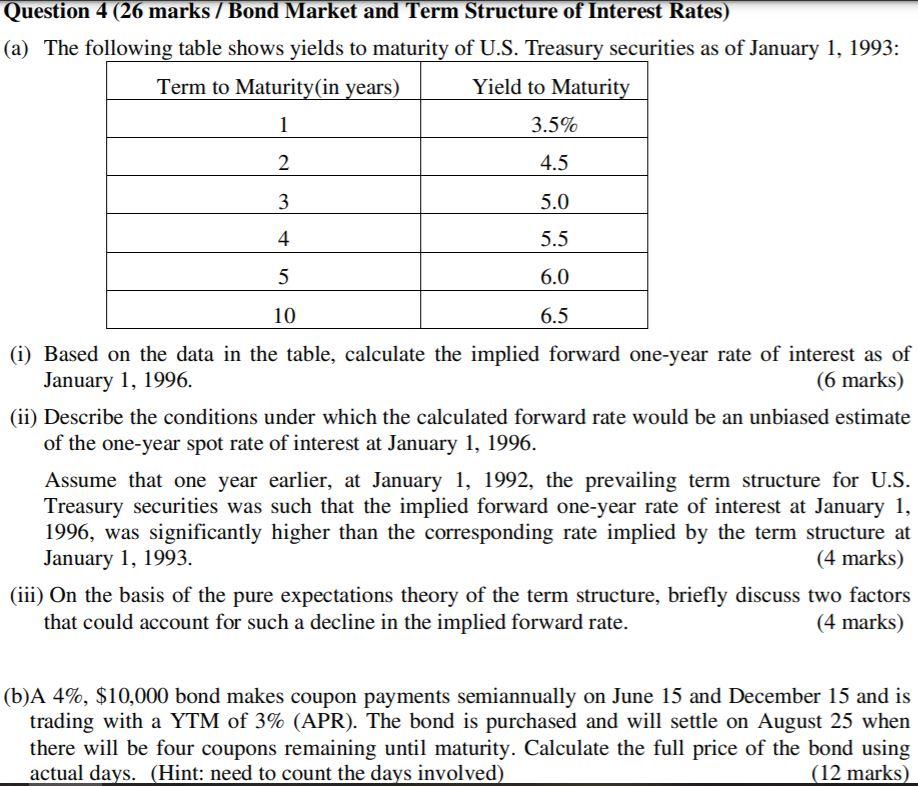

Question 4 (26 marks / Bond Market and Term Structure of Interest Rates) (a) The following table shows yields to maturity of U.S. Treasury securities as of January 1, 1993: Term to Maturity(in years) Yield to Maturity 1 3.5% 2 4.5 3 5.0 4 5.5 5 6.0 10 6.5 (i) Based on the data in the table, calculate the implied forward one-year rate of interest as of January 1, 1996. (6 marks) (ii) Describe the conditions under which the calculated forward rate would be an unbiased estimate of the one-year spot rate of interest at January 1, 1996. Assume that one year earlier, at January 1, 1992, the prevailing term structure for U.S. Treasury securities was such that the implied forward one-year rate of interest at January 1, 1996, was significantly higher than the corresponding rate implied by the term structure at January 1, 1993. (4 marks) (iii) On the basis of the pure expectations theory of the term structure, briefly discuss two factors that could account for such a decline in the implied forward rate. (4 marks) (b)A 4%, $10,000 bond makes coupon payments semiannually on June 15 and December 15 and is trading with a YTM of 3% (APR). The bond is purchased and will settle on August 25 when there will be four coupons remaining until maturity. Calculate the full price of the bond using actual days. (Hint: need to count the days involved) (12 marks) Question 4 (26 marks / Bond Market and Term Structure of Interest Rates) (a) The following table shows yields to maturity of U.S. Treasury securities as of January 1, 1993: Term to Maturity(in years) Yield to Maturity 1 3.5% 2 4.5 3 5.0 4 5.5 5 6.0 10 6.5 (i) Based on the data in the table, calculate the implied forward one-year rate of interest as of January 1, 1996. (6 marks) (ii) Describe the conditions under which the calculated forward rate would be an unbiased estimate of the one-year spot rate of interest at January 1, 1996. Assume that one year earlier, at January 1, 1992, the prevailing term structure for U.S. Treasury securities was such that the implied forward one-year rate of interest at January 1, 1996, was significantly higher than the corresponding rate implied by the term structure at January 1, 1993. (4 marks) (iii) On the basis of the pure expectations theory of the term structure, briefly discuss two factors that could account for such a decline in the implied forward rate. (4 marks) (b)A 4%, $10,000 bond makes coupon payments semiannually on June 15 and December 15 and is trading with a YTM of 3% (APR). The bond is purchased and will settle on August 25 when there will be four coupons remaining until maturity. Calculate the full price of the bond using actual days. (Hint: need to count the days involved) (12 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts