Question: Question 4 ( 3 0 points ) Consider a standard portfolio choice problem with two risky assets: equity and risky bon Their expected returns, standard

Question points

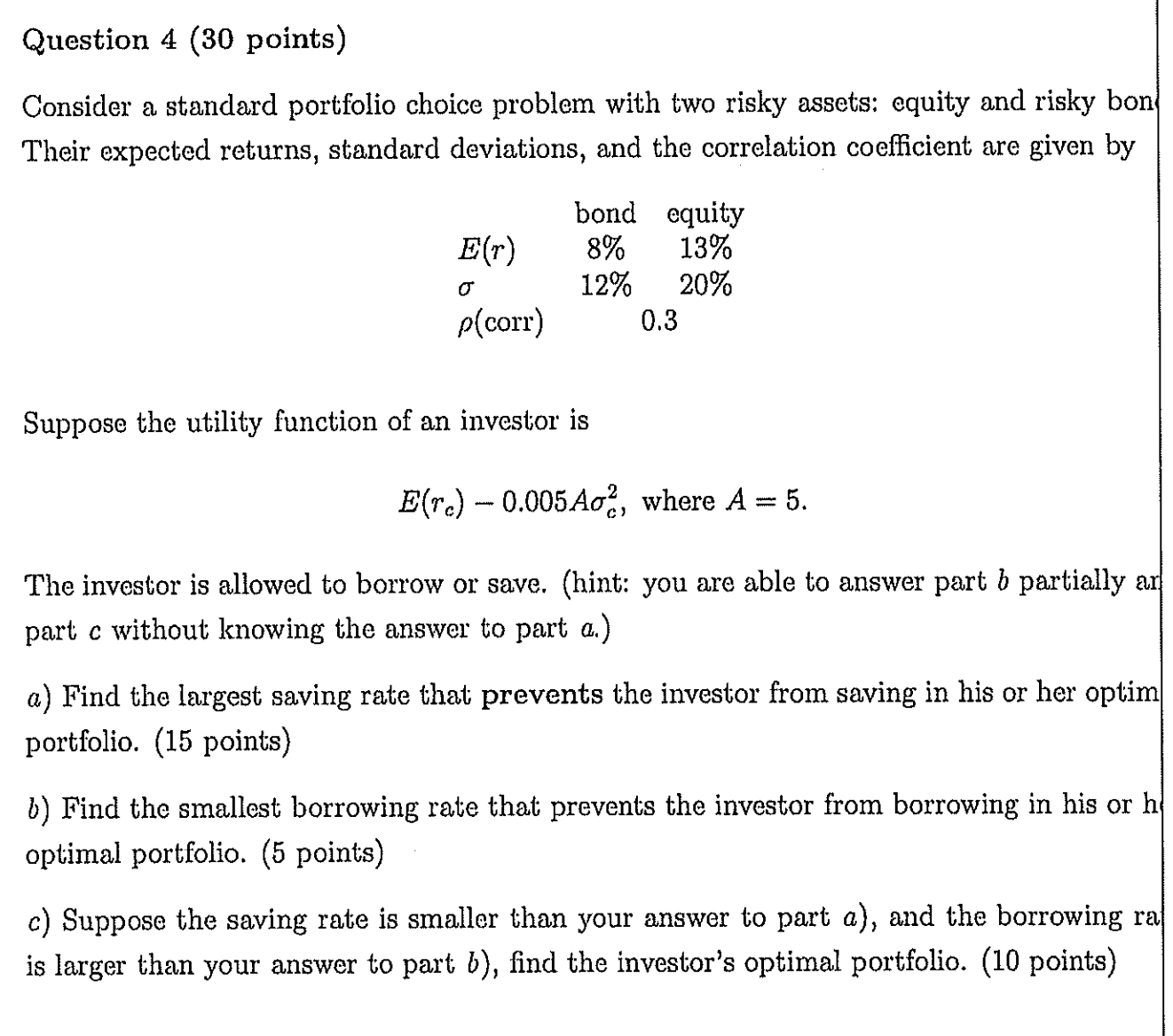

Consider a standard portfolio choice problem with two risky assets: equity and risky bon

Their expected returns, standard deviations, and the correlation coefficient are given by

Suppose the utility function of an investor is

where

The investor is allowed to borrow or save. hint: you are able to answer part partially an

part without knowing the answer to part

a Find the largest saving rate that prevents the investor from saving in his or her optim

portfolio. points

b Find the smallest borrowing rate that prevents the investor from borrowing in his or h

optimal portfolio. points

c Suppose the saving rate is smaller than your answer to part a and the borrowing ra

is larger than your answer to part b find the investor's optimal portfolio. points

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock