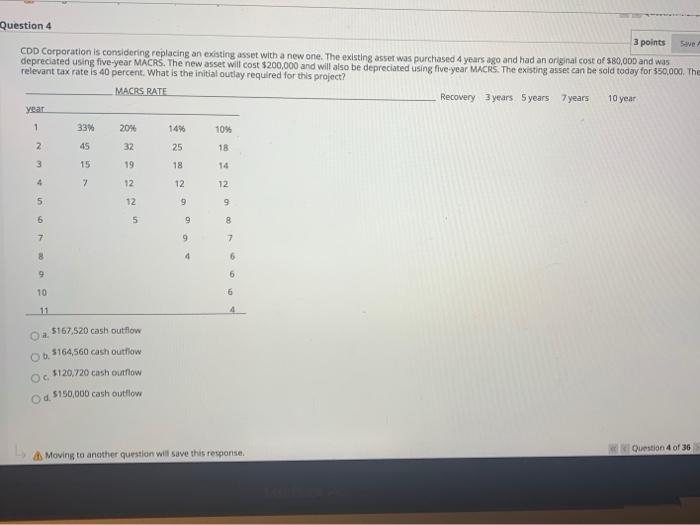

Question: Question 4 3 points CDD Corporation is considering replacing an existing asset with a new one. The existing asset was purchased 4 years ago and

Question 4 3 points CDD Corporation is considering replacing an existing asset with a new one. The existing asset was purchased 4 years ago and had an original cost of $80,000 and was depreciated using five-year MACRS. The new asset will cost $200,000 and will also be depreciated using five year MACRS. The existing asset can be sold today for 350,000. The relevant tax rate is 40 percent. What is the initial outlay required for this project? MACRS RATE Recovery 3 years 5 years 7years 10 year year 1 33% 20% 14% 10% 2 45 32 25 18 3 15 19 18 7 12 12 12 5 12 9 9 6 5 9 8 7 9 7 8 4 6 9 6 10 6 a. 5167,520 cash outflow Ob 5164,560 cash outflow $120,720 cash outflow od 5150,000 cash outflow Question 4 of 36 Moving to another question will save this response

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts