Question: Question 4 (3 points) In practice, a common way to value a share of stock when a company pays dividends is to value the dividend

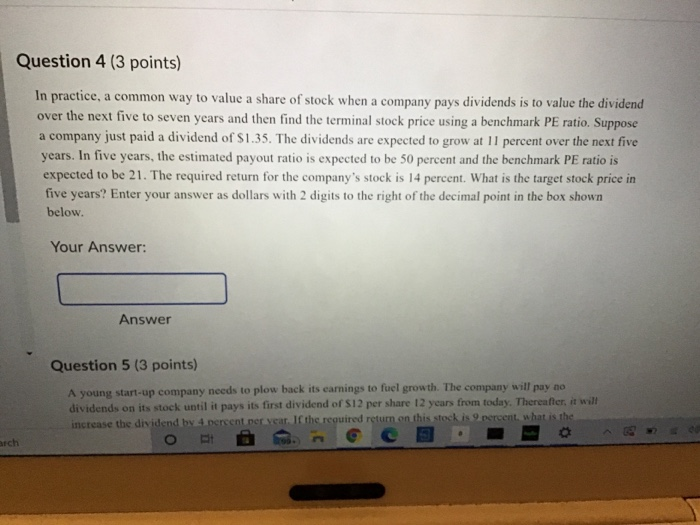

Question 4 (3 points) In practice, a common way to value a share of stock when a company pays dividends is to value the dividend over the next five to seven years and then find the terminal stock price using a benchmark PE ratio. Suppose a company just paid a dividend of $1.35. The dividends are expected to grow at 11 percent over the next five years. In five years, the estimated payout ratio is expected to be 50 percent and the benchmark PE ratio is expected to be 21. The required return for the company's stock is 14 percent. What is the target stock price in five years? Enter your answer as dollars with 2 digits to the right of the decimal point in the box shown below. Your Answer: Answer Question 5 (3 points) A young start-up company needs to plow back its earnings to fuel growth. The company will pay no dividends on its stock until it pays its first dividend of S12 per share 12 years from today. Thereafter, it will increase the dividend by 4 percent per year. If the required return on this stock is 9 percent, what is the O arch

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts