Question: QUESTION 4 (4 points, 2 points each section) You own 100,000 ounces of gold. You expect the gold market to be too volatile in the

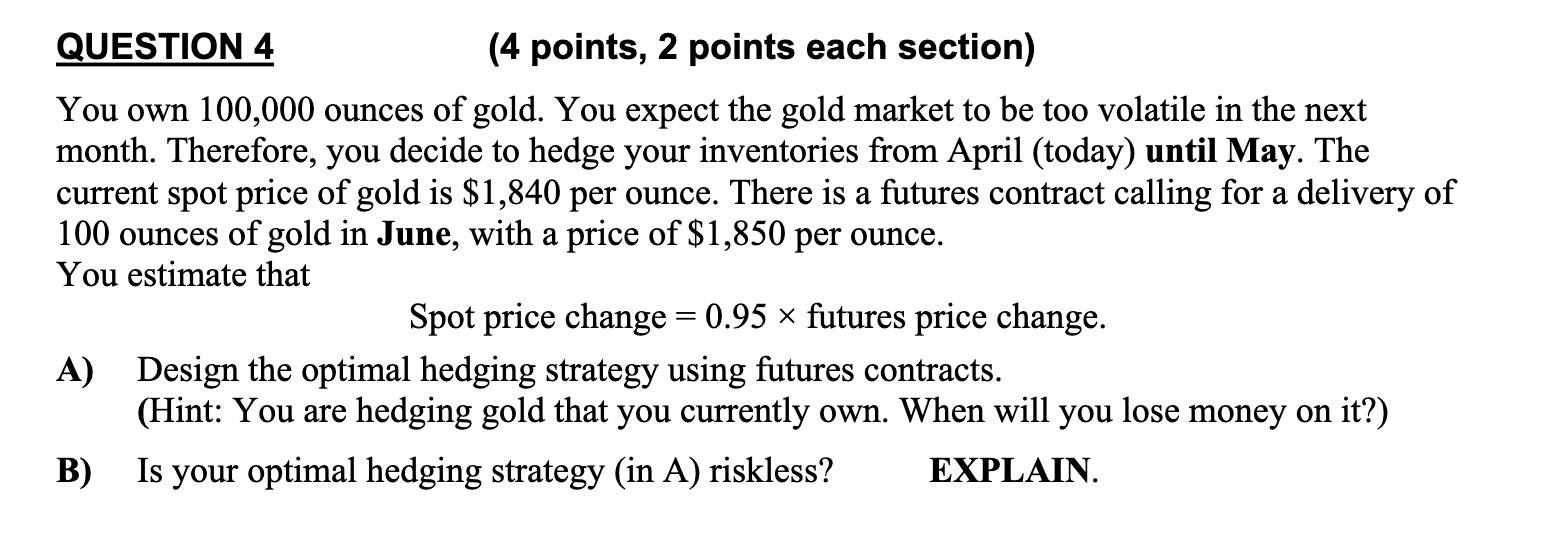

QUESTION 4 (4 points, 2 points each section) You own 100,000 ounces of gold. You expect the gold market to be too volatile in the next month. Therefore, you decide to hedge your inventories from April (today) until May. The current spot price of gold is $1,840 per ounce. There is a futures contract calling for a delivery of 100 ounces of gold in June, with a price of $1,850 per ounce. You estimate that Spot price change =0.95 futures price change. A) Design the optimal hedging strategy using futures contracts. (Hint: You are hedging gold that you currently own. When will you lose money on it?) B) Is your optimal hedging strategy (in A) riskless? EXPLAIN

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts