Question: Question 4 4.1 Calculate the NPV over six years using the discount rate of 11%. 4.2 This project does not end after sixth year, but

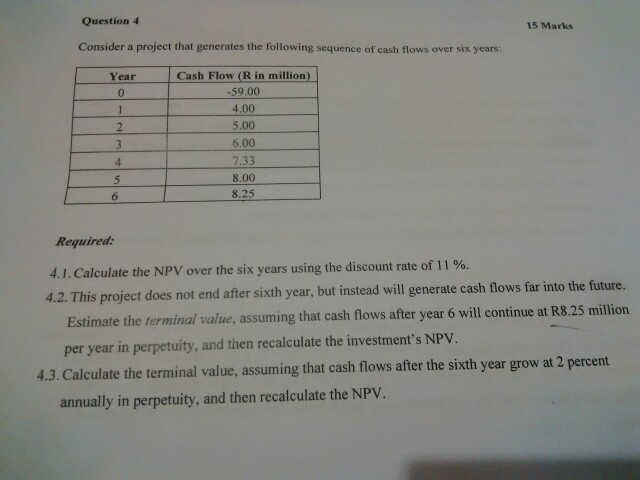

Question 4 4.1 Calculate the NPV over six years using the discount rate of 11%. 4.2 This project does not end after sixth year, but instead will generate cash flows far into the future. Estimate the terminal value, assuming that cash flows after year 6 will continue at R 8.25 million per year in pertuity, and then recalculate the investments NPV. 4.3 Calculate the terminal value, assuming that cash flows after the sixth year grow at 2 percent annually in pertuity, and then recalculate the NPV.

Question 4 15 Marks Consider a project that generates the following sequence of cash flows over six years Year 0 Cash Flow (R in million) -59.00 2 5 .00 6.00 7.33 8.00 8.25 Required: 4.1. Calculate the NPV over the six years using the discount rate of 11 %. 4.2. This project does not end after sixth year, but instead will generate cash flows far into the future. Estimate the terminal value, assuming that cash flows after year 6 will continue at R8.25 million per year in perpetuity, and then recalculate the investment's NPV. 4.3. Calculate the terminal value, assuming that cash flows after the sixth year grow at 2 percent annually in perpetuity, and then recalculate the NPV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts